The reports detail the commercial landscape, regulatory developments, investments and innovations in the plant-based, cultivated meat and fermentation sectors.

The Good Food Institute’s (GFI) annual deep-dive reports offer a global snapshot of the state of play for each alternative protein sector, and, for the first time, the not-for-profit has also released a fact sheet on plant molecular farming, “a potential fourth pillar of alternative protein production”, which combines plant agriculture and techniques similar to those used in precision fermentation to enable the production of animal proteins in plants.

Key findings: Plant-based meat, seafood, eggs and dairy

- In 2022, the plant-based meat and seafood retail industry generated $6.1b in global sales, up eight percent by dollars and five percent by weight. Combined plant-based milk, cheese, and yogurt hit $21.6b on the global stage, up seven percent from 2021.

- Hundreds of new plant-based products hit US shelves in 2022, including in emerging categories like plant-based steak, salmon, foie gras and fish balls. There was also a number of large food companies active in the space, with Philadelphia, Babybel and Kellogg’s releasing new plant-based products.

- Six companies opened new or expanded production facilities, and 11 new plant-based contract manufacturers were added to GFI’s database, bringing the total number of known plant-based contract manufacturers to 127.

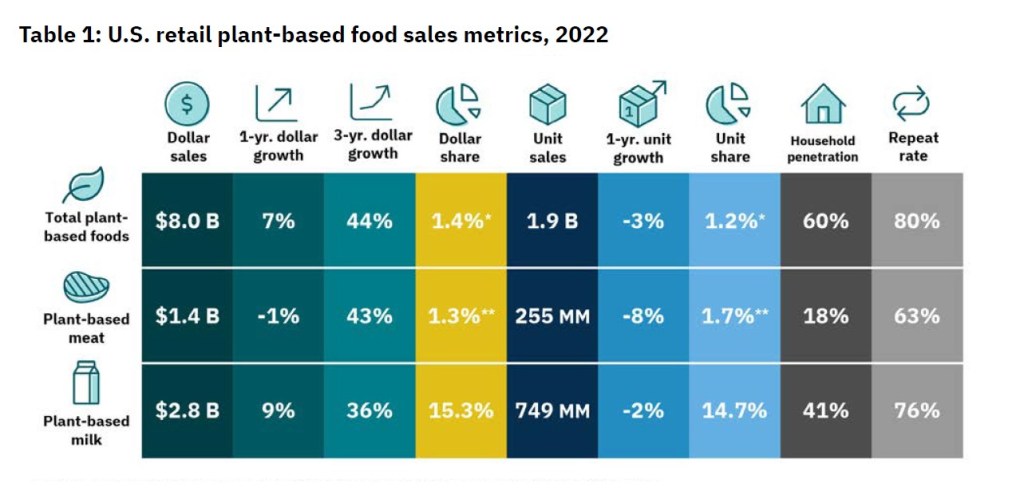

- Total US retail plant-based food sales reached $8b in 2022. Dollar sales were up seven perent, while unit sales dropped three percent. Plant-based meat dollar sales dropped one percent and unit sales dropped eight percent. Plant-based milk dollar sales grew nine percent to $2.8b, while unit sales dropped two percent. Categories that saw both dollar and unit sales growth included plant-based eggs, plant-based seafood, plant-based creamers, plant-based protein liquids and powders.

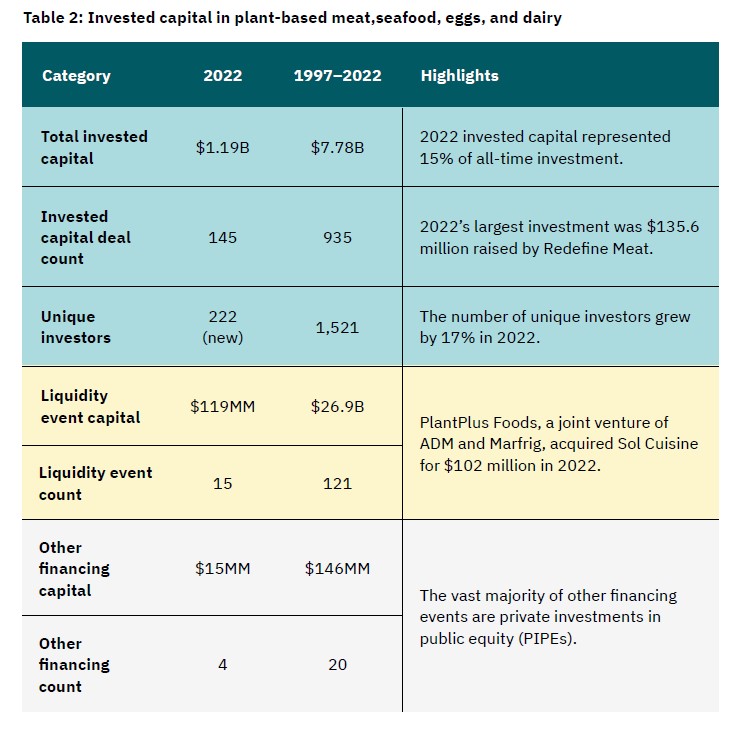

- Plant-based companies raised $1.2b in 2022, representing 15 percent of all-time investment (since 1997), bringing total investment to $7.8b. The number of unique investors grew 17 percent to more than 1,500 investors.

- Europe led investments in plant-based protein with commitments from Denmark, Sweden and Switzerland to invest more than $150m in R&D. In the US, support for alt protein R&D was secured at both state and federal levels, with Congress allocating nearly $6m the USDA and California allocating $5m to three universities.

Key findings: Cultivated meat and seafood

- In the US, the FDA completed its first premarket review for a cultivated meat product (UPSIDE Foods’ chicken, followed by GOOD Meat’s).

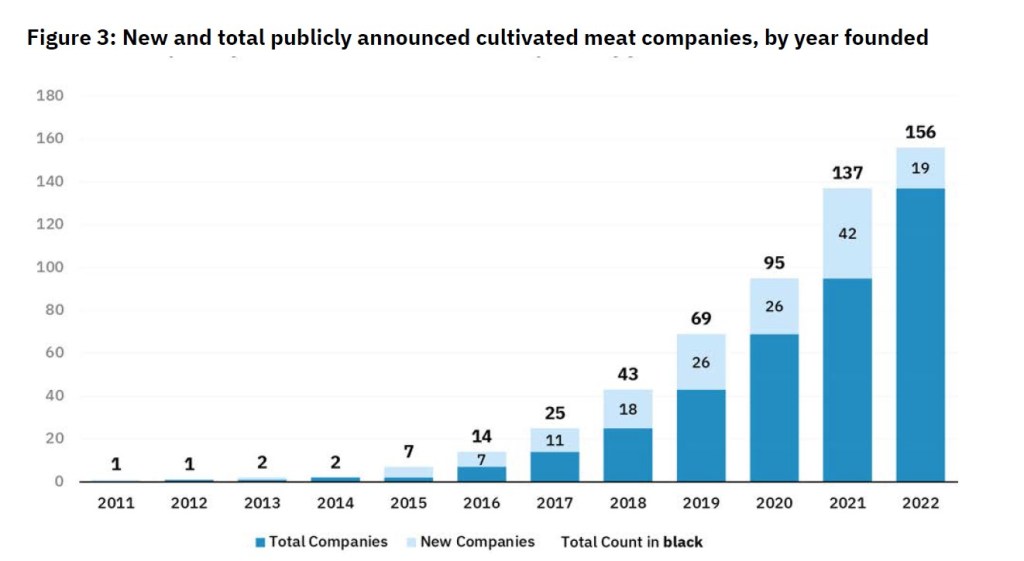

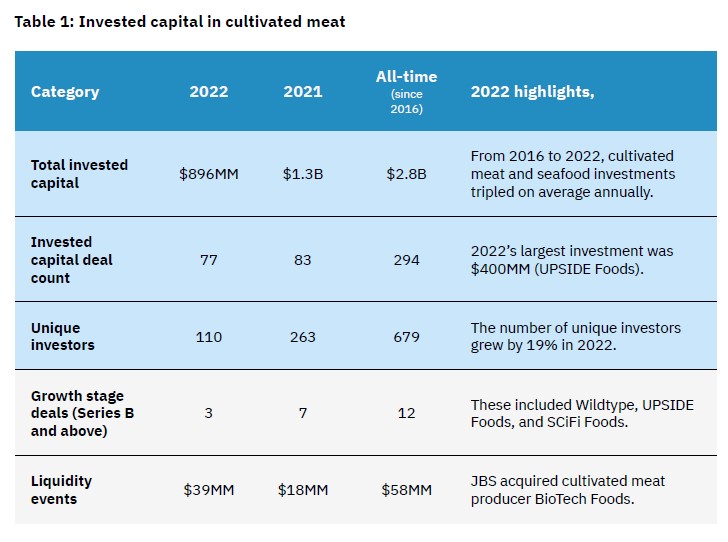

- The largest deal to date for both a cultivated meat and seafood company occurred in 2022 (UPSIDE Foods and Wildtype). The number of unique investors grew by 19 percent to 679. Median deal sizes by round were generally higher in 2022 than 2021, a year of record funding.

- There are now more than 70 diversified companies with activity in cultivated meat, up from 60 last year, including the world’s top three meat companies by revenue.

- U.S.-based Alliance for Meat, Poultry, and Seafood Innovation, the APAC Society for Cellular Agriculture, and Cellular Agriculture Europe teamed up to launch a new global alliance to collaborate on regulatory work, consumer research, and nomenclature.

- Cultivated meat and seafood companies raised $896m in 2022, bringing the total for the industry, since 2016, to $2.78b. This represents a deceleration of 33 percent year on year, however this rate is an improvement on the 35 percent year on year overall global funding decline.

- APAC and Europe saw higher cultivated meat investments in 2022 than the year prior. In APAC, cultivated meat companies raised more in 2022 than in all prior years combined.

- 13 multi-year research projects, including those focused on cell lines, serum-free cell culture media development, and scaffolding were published, many in open-access journals, and universities worldwide launched seven new alternative protein courses and one certificate program.

- In Europe, the Netherlands announced $65m in funding for cultivated meat and precision fermentation, the world’s largest-ever public investment in the cellular agriculture field. The US Congress directed nearly $6m in research funds to alternative protein R&D. California approved the first-ever state investment in cultivated meat research, directing $5m to R&D.

Key findings: fermentation

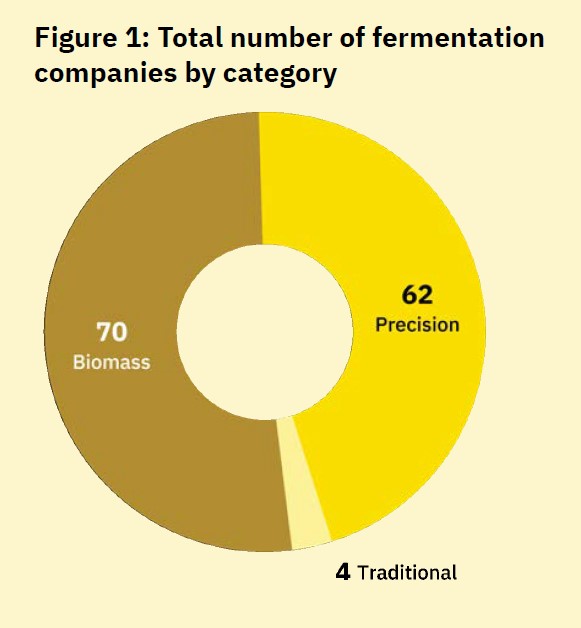

- The number of companies focused on fermentation for alt proteins rose to 136, up 12 percent. At least 100 additional companies have a business line in alt protein fermentation, including Nestle, Unilever and Bel Group.

- Industry bodies including the new Fungi Protein Association and Precision Fermentation Alliance were formed, helping to advance fair policies, consumer research, regulatory advancements and consumer messaging.

- In 2022 companies applied fermentation technology to develop end products and ingredients to enhance plant-based products. A number of companies used Perfect Day’s whey protein for new products including animal-free milk and ice cream, chocolate and protein powder. The EVERY Company’s precision fermentation egg proteins were used to launch macarons and a line of juices featuring animal-free egg protein.

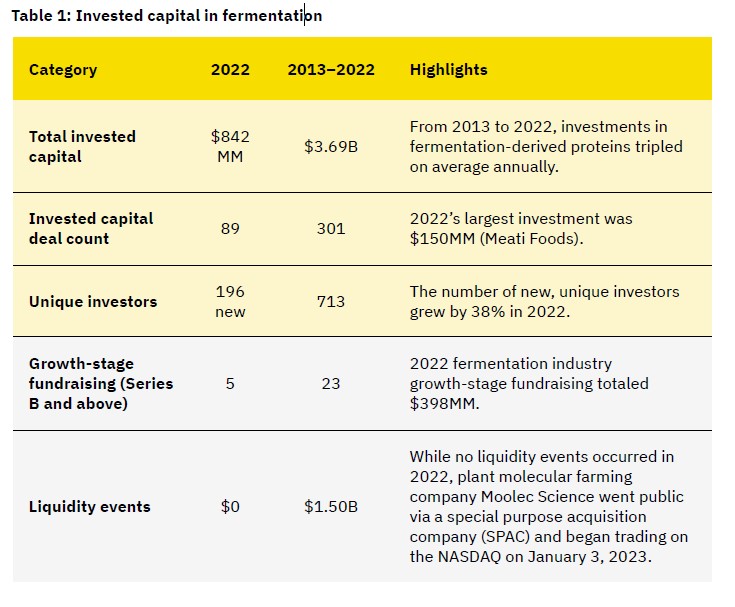

- Fermentation companies raised $842m in 2022, a year on year deceleration “mirroring similar trends across markets amid challenging macroeconomic conditions and other global factors,” GFI says. Despite this, investments in 2022 represented almost 25 percent of all-time funding, and funding grew in APAC by 67 percent, Europe by 37 percent and the Middle East and Africa by 26x. The number of unique investors grew by 38 percent to 713.

- Europe funneled more than $155m into cellular agriculture research and commercialisation, including microbial fermentation and cultivated foods. The Netherlands announced a record-breaking $65m investment in cell agriculture and the completion of one of the world’s largest protein facilities. The UAE supported the construction of a precision fermentation facility in Abu Dhabi, to be operated by Change Foods.

Download the full reports here.

To stay up-to-date on the latest industry headlines, sign up to Future Alternative’s enewsletter.

Posted on: