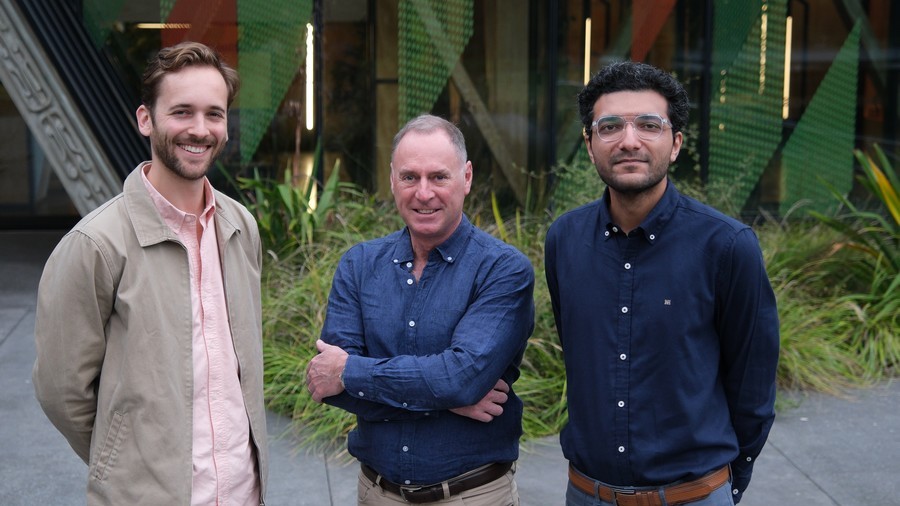

New Zealand start-up Jooules is one in only a small handful of companies across the world producing air-based proteins, deriving its product from CO2 emission streams via gaseous fermentation.

The company — which claims its processes will consume roughly 600 times less water and 99% less land compared to traditional protein production — recently received an approximately USD $600,000 investment from Sprout Agritech LP to commercialise its technology.

Jooules Founder David McLellan sat down with Future Alternative to discuss the role of gaseous fermentation in sustainable food production, the approval process across various countries, and why the company is eying Asia as a potential market for expansion.

You have considerable experience working in energy retail, especially renewable energy. How do you get from there to alternative proteins?

I admit I have a very varied background – actually it’s three decades of commercial experience. That’s across financial markets, energy markets, a lot of wholesale energy and management consulting as well across public and private sectors.

But within that there’s been about six startups as well, including a thermal processing food company, equivalent to canning but using flexible pouches, which we did in the early 2000’s. That was pretty bleeding edge stuff. I also developed the Australian electricity futures contract and market, which is a big deal and made a huge difference to that industry.

For me it’s about solving a problem as opposed to having a solution. For us, the problem we’re solving here is one of sustainably producing enough food for everyone when we’ve got a growing population and we’re faced with climate change, which is negatively impacting on our very ability to actually produce enough food. The agri-food system is responsible for some 30% of our greenhouse gas emissions. So there’s a definite problem to be solved there, in fact numerous ones.

That’s how we went down this pathway. And having looked at a number of solution sets, we arrived at gaseous fermentation as making the most sense and ticking the most boxes in terms of a sustainable, scalable, and ethical way of producing proteins.

Fermentation bioreactors need to run on renewable energy in order to produce sustainable results. If applied in countries with limited renewables, how do you see this technology achieving those decreases in emissions within a reasonable timeframe?

It’s obviously correct that one of the key resource needs of a system like this is that renewable energy source, in particular to produce the green hydrogen to operate it. New Zealand is up in the 90 percent range and has even had instances of 100% renewables on some days. We’re fortunate in that sense.

But in other countries or jurisdictions, the growth rate in their wind and solar is phenomenal. So I think depending on the selected markets, there are certainly opportunities. And if there aren’t today, there will be tomorrow – for solar or wind hookup to produce proteins.

The CO2 component is important as well. We’ve chosen to essentially focus on sourcing directly from an emissions source in the first instance because it’s easier to capture it as it’s going into the atmosphere as opposed to trying to use some kind of direct air capture tech to sift it out when it’s parts per million. But direct air capture tech will get to a point where it is viable a few years down the way. That means that you just need a source of renewable energy – such as solar panels or a wind farm in the vicinity – to support a set of bioreactors.

Eventually, we and others will have tackled that emissions problem and then we’ll need to move on to direct air capture solutions because those point sources will have been solved either by being used for something like what we’re doing or actually removed by the replacement of coal or gas-fired furnaces and boilers with electric ones.

Do you see gaseous fermentation as a solution that will work alongside precision fermentation and cultivated meat to achieve the goal of decreasing emissions, or as a more effective technology that will replace those other ones?

There’s an interesting set of definitions at play. This term, precision fermentation, essentially means you’re going to genetically engineer a microbe and you’re going to use a fermentation process to produce a target molecule. The broad assumption is that that will involve a yeast and that therefore, precision fermentation equals yeast-based fermentations, which require a sugar carbohydrate feedstock to make them work. And they need a lot of it. As we know, yeasts like eating sugars. So it’s a conversion of sugars into a target molecule.

But actually, we can engineer our microbes just the same. We can also use precision fermentation to produce a target molecule, as opposed to biomass fermentation, whereby the production is a single cell protein (SCP), which is our target product. But we also intend to engineer our strains for the production of some high value target protein molecules as well. But they’ll be produced out of a gaseous fermentation process, as opposed to a yeast and sugar based process.

The reason we’ve chosen gaseous is because we believe it’s the most efficient and scalable fermentation process. It doesn’t require a feedstock such as a sugar or other carbohydrate based feedstock to make it work. It’s using greenhouse gases and hydrogen, which is the most abundant element in the universe. So it’s scalable, whereas, if you’re having trouble growing crops, that means you’re going to have price volatility in your core feedstock if you are relying on those crops to feed your yeasts.

Have you observed any countries that have already begun the process for developing a regulatory model for this technology that FSANZ (Food Standards Australia New Zealand) could take as a reference? Or is it so early that no one knows quite how to talk about this yet?

Solar Foods has received novel food approval for their Solein product in Singapore. Singapore is very proactive in the alt protein space given that they want food security and they’re importing 95% of their food at the moment. So they’ve obviously developed a regulatory framework for approving novel foods, or foods which don’t have any history of consumption by humans.

In our case, the approving authority would be FSANZ. My understanding is that in cellular agriculture, Australia has been doing good work and trying to push forward for the development of an appropriate regulatory framework. I think the reality is that New Zealand is behind on that.

But we could look to countries like the Netherlands, who are very proactive towards such tech and alt proteins in general. And I think South Korea is probably one to watch, given that they’ve just announced mega investments into alt proteins. So we’ll probably move quite quickly as well.

There is a pathway for us to gain approval here under FSANZ. It’s a statutory process which requires a minister to sign off within a fixed time duration of nine months. So you need to present proof that you are producing safe food, which there’s a known pathway for as well. I think the broader framework and strategy aren’t really in place, but the building blocks are starting to come together.

Would New Zealand be among the first markets you would target for commercial sale of your proteins, or would you be targeting another market, for example, like Singapore, where they are likely to gain regulatory approval more quickly?

I think the reality is that we would probably seek approval via FSANZ and the Singapore food authority simultaneously. They are quite closely aligned, and so there’s a great deal of cross crediting that goes on between those processes. I guess given that Solar Foods has gained approval in Singapore, it would give one some confidence that the pathway is a little bit smoother than it is with FSANZ. But that’s probably the first sort of cab off the rank for us. It’s not that we’d expect to be selling much in New Zealand, given the modest sized population, but I think certainly they’re part of our Asia Pacific market focus.

Private investment in novel food technologies is going down much in the way that it is in other sectors. Your earliest funding came from Sprout. Do you plan to approach private VCs for your next fundraise or will you be seeking other channels?

I think you’re right in the sense that capital markets in general have come well off their 2021 and 2022 peaks and that’s affected the agritech funding space. But the reality is we’re still ahead of where we were prior to those peaks. And amongst the alt protein spaces that are getting funded, fermentation is right up near the top. So I’m pretty comfortable where it’s at.

I’ve never known raising money to be easy and I’ve never managed to hit a peak period either. It’s always tough. We’ll be going out in the next few months for what will be our second round. It’ll be VC’s who have an interest and knowledge in what we can call the old protein space more broadly. But there are some who particularly like fermentation as a segment.

And we won’t just be looking in Australia and New Zealand either. We went through the Proveg accelerator in Berlin in late 2022, so we’ll definitely be looking through Proveg’s network. Some of the VC’s in Europe do invest in the fermentation space in particular, and also in Asia Pacific there are a number of VCs who are known to invest in this space. This is a good proposition and we’re making good progress. So one must remain confident when seeking money.

Fonterra was involved in your latest funding round. Some fermentation companies I’ve spoken to have said that Fonterra is not really touching that space yet. How were they involved?

The Sprout fund sits alongside the Sprout Agritech accelerator, which we went through early last year, and the Sprout fund has three limited partners backing it. One of those is global agritech VC, Our Crowd. The other one is Finistere Ventures, another global agritech VC. The third partner is Fonterra.

The reason Fonterra is in there is because at the time they set that fund up, Fonterra didn’t have its own corporate venture capital arm at all. So it made sense for them to get involved at that level so they could see what’s going through and what opportunities there might be. Of course, now they’ve established their own corporate VC in the Ki Tua Fund, which is up and running. And they are looking at various spaces that align with what they do there at Fonterra.

With regards to fermentation and Fonterra, we all look at them as a big milk company. I think the reality is a little bit different. They’re actually a very large nutrition research and development house, in fact, the largest singular R&D house of its kind in the world as I understand it. So of course they’re looking at all sorts of ways to produce high value to human health nutritionals.

I can’t talk for them, but I think they’ve worked out that while some of these molecules may be in milk, it’s non-economical to extract them. Lactoferrin is one of them. But if you were to use a fermentation technology to produce those molecules and others, it may be a much better outcome and it will sit comfortably alongside their core business.

And that’s why, to be fair, Fonterra’s got that partnership with Royal DSM out of the Netherlands to use precision fermentation. I guess that’s how they learn. But I’d imagine if you turned up to Fonterra and said, ‘I’m going to produce casein or whey proteins using fermentation,’ they wouldn’t be that supportive.

Corporate VCs seem to be playing an increasingly important role in getting these technologies to scale and up to the level they need to be.

That’s absolutely true. Kraft, and ADM are in the space, as is Cargill. They’re definitely wading in, but they’re corporates and they’re big, so we can’t expect them to be too fast.

Have you begun to line up potential customers for your proteins? And what kind of products do you foresee your proteins going into?

The reality is, it’s a bit early for us to do that because we can’t present a suitable quantity of prototype product. So whilst we may be doing rapid prototyping, it’s not at a point where we could present that as an ingredient to a potential customer. We’ve held off on those conversations, but they’ll come in good time. Part of it is that we need to have the ability to be able to produce enough for people to play around with it, and that’ll probably be next year.

But yes, this core SCP biomass product could find its way into all sorts of manufactured foods. Anything that needs a protein content and doesn’t need to look like whole cut meat is a potential candidate. I think the cuisine of Asia works pretty well with the idea, such as dumpling stuffings or any kind of sausage, dishes where form is less critical.

And of course, there’s also the companion animal (pet) channel, which represents 25% of meat consumption globally. From an achieving sustainability perspective, it makes a lot of sense to formulate some of those pet foods with bulk proteins like this that are sustainable, ethical, and avoid the allergens that they are getting from using soy and wheat proteins.

Which other markets in APAC do you foresee as possible first targets?

I think Japan’s got a lot of potential, as well as South Korea. Even though China is obviously the biggest protein market in the region, you’ve got to take into context what we think we are going to be able to produce scale-wise. At the moment, we’re saying that by 2030, we want to be capable of producing something like 50,000 tons per annum.

But in the scheme of things, it’s a drop in the ocean, for example, if you compare it to the scale of dried milk powders that Fonterra exports. But still, you can’t supply everyone with that. And that’s in the context of milk proteins being expected to grow by another 400,000 tons per annum by 2030. So it puts our 50,000 tonnes in context.

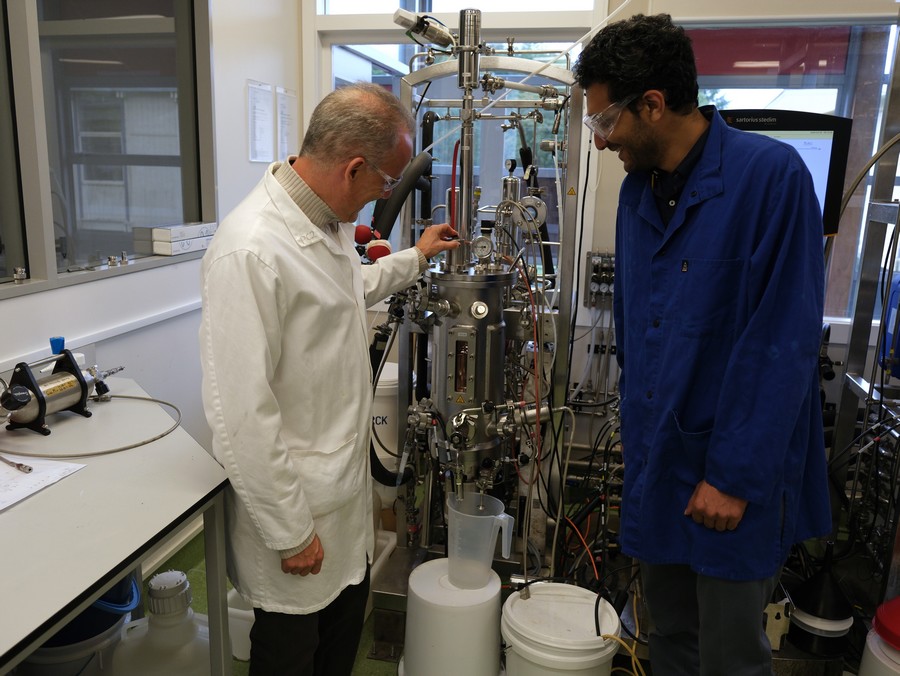

We’re working closely with Scion and accessing equipment via their labs in Rotorua, which we’re very grateful for because the technology that we need and use is pretty rare. It’s certainly a lot rarer than the fermentation vessels required for yeast fermentation. And we hope to be able to expand our footprint up there in Rotorua as well.

It makes a lot of sense to us to keep everything in New Zealand and help build a more resilient and growth-oriented economy right here. We don’t want to have to go offshore just to get at the tech and assistance we need, given the capability we’ve got here.

We’re hopeful that authorities here in New Zealand get a bit of a wriggle on to get this framework in place, because otherwise it’s like operating in a vacuum. There’s no sense in leaving it to someone else when there’s an opportunity like this for the productivity of this country.

To stay up-to-date on the latest industry headlines, sign up to Future Alternative’s enewsletter.

Posted on: