The alternative proteins sector should take inspiration from the success of the electric vehicle (EV) industry, according to a new report released by Boston Consulting Group (BCG), the Good Food Institute (GFI), and Synthesis Capital.

The report – titled What the Alternative Protein Industry Can Learn from EV Companies – highlights the path the EV sector has taken to achieving mass adoption and how the alternative proteins industry may replicate that success. It does this by drawing numerous parallels between the industries – both are major contributors to the overall global GHG emissions speeding up climate change, with passenger road transportation accounting for 10% of emissions and animal agriculture for 15% to 20%.

What’s more, both industries are, “disruptive technologies taking on incumbents whose products are rooted in consumer culture and identity.”

Both sectors have also faced hurdles to gaining consumer trust. EVs have received scrutiny for issues such as battery fires, consumer range anxiety, limited charging infrastructure, and ecological and ethical issues related to the mining and processing of raw materials for EV batteries. Alternative proteins, similarly, have been criticised for the level of processing used to create some plant-based substitutions.

The two industries also confronted early challenges in scaling production, a challenge the alt proteins sector is still struggling to overcome.

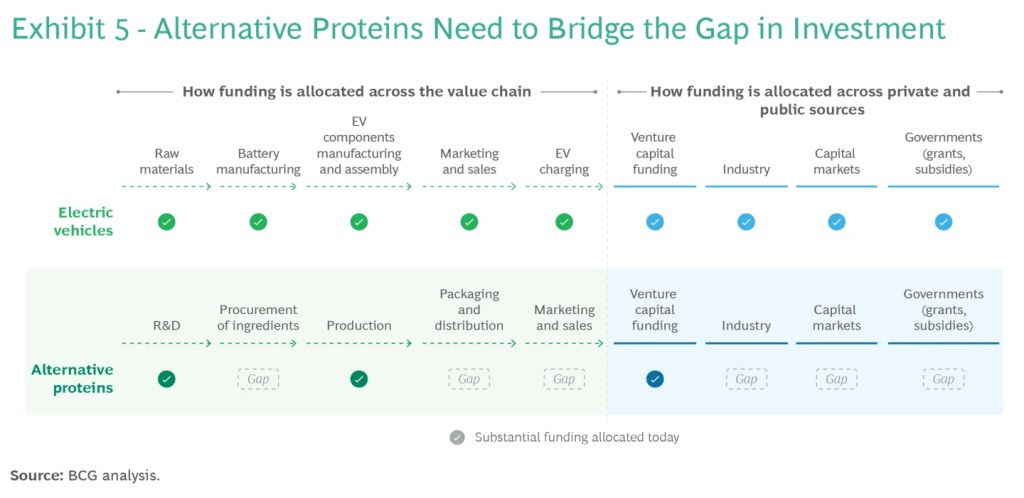

However, the gap between the support both industries have received is striking – governments worldwide provided roughly $40 billion in direct purchase subsidies for EVs in 2022, according to the International Energy Agency. The alternative protein industry, meanwhile, received $635 million in total government support that same year, a tiny fraction of that put towards driving EV adoption.

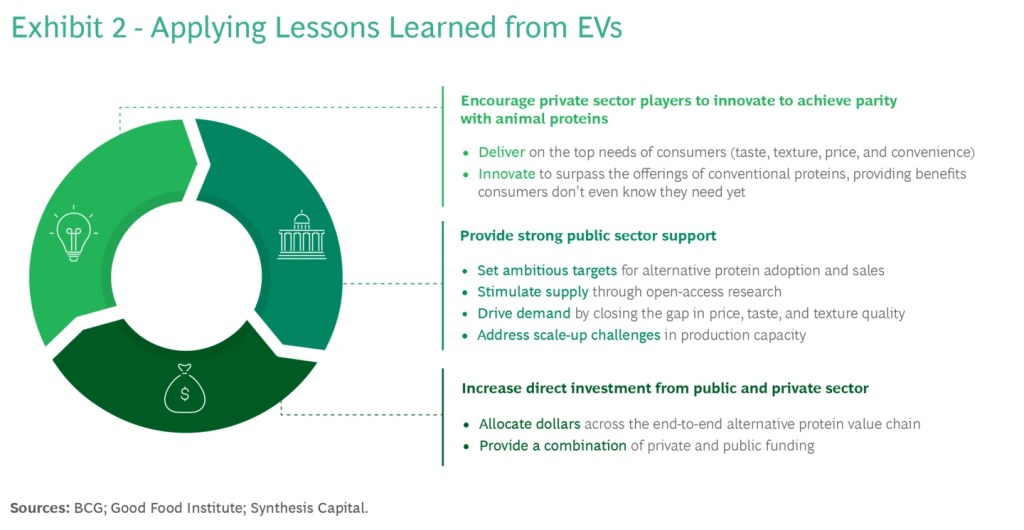

In response, the report provides a series of lessons learned by the EV industry for the alt proteins industry to take as a reference.

Innovate to achieve parity with or even surpass traditional options

EV makers have succeeded in significantly closing the gap with petrol-powered vehicles in terms of price, range, and model selection. They achieved this by putting their public and private investments towards innovation.

The report encourages alt protein makers to achieve similar results by creating innovative products that match animal proteins in taste, texture, price, and convenience, rather than just addressing environmental and ethical concerns.

Moreoever, beyond focusing on sustainability, EV makers like Tesla have sought to develop innovative features not found in most traditional cars, producing vehicles with advantages like low cost of ownership, self-driving technology, and active safety features.

In the case of alt protein producers, this would equate to creating products with benefits such as enhanced nutrition, novel tastes and flavours, or that address consumer food allergies or other special dietary needs.

Build a supportive public sector

EV adoption has been accelerated throughout the world by ambitious policies, such as the dual-credit system for new-energy vehicles in China and the European Union’s Green Deal.

The report argues that beyond the financing provided by governments to support domestic market development for products like cultivated and fermented foods, more funding is needed to achieve producing such proteins at scale.

And as it is start-ups conducting much of the research, technological breakthroughs are treated as proprietary. By funding open-access research instead, governments can help alt protein companies to achieve scale collectively.

Governments can also stimulate demand by making the regulation process for alt protein products faster in the way they have for EVs by helping start-ups build more labs and add demonstration-scale capacity.

As GFI senior associate director of industry intelligence & initiatives Emma Ignaszewski notes: “Securing public funding—which has been instrumental for EV innovation—is critical for alternative proteins to scale and compete with conventional meat on taste and price. And competing on these drivers of consumer choice is the blueprint for alternative proteins to help decarbonise the food sector, just as electric vehicles can help decarbonise the transportation sector.”

Allocate dollars across the value chain

Lastly, the report emphasises the importance of building resilient supply chains that support the full spectrum of activities, from early R&D all the way through ingredient sourcing and consumer sales. This requires new behaviours from a variety of stakeholders.

The primary onus is on governments to serve as catalysts for alt protein innovation in the way they have for the EV sector by funding R&D, helping companies to source raw materials, and building effective production processes and infrastructure.

Investors, meanwhile, should encourage companies in their portfolio to devote a sufficient amount of their resources to R&D innovation that closes the gap between traditional proteins and their alt protein products.

Incumbent food companies must also play an important role by setting industry standards as well as resetting consumer expectations towards alt protein products.

Lastly, like EVs to traditional petrol-powered vehicles, alt protein companies need to out-innovate conventional proteins by providing additional health benefits and customising products to meet consumers’ dietary needs, allergies, and taste preferences.

To stay up-to-date on the latest industry headlines, sign up to Future Alternative’s enewsletter.

Posted on: