HealthyLife, a Woolworths brand, has released a new report sharing insights into Australians’ health and wellbeing, including their grocery shopping and eating habits.

The Living Healthy Report 2023 used Woolworths aggregated transaction data between 2020 and 2022, together with Woolworths market share, ABS household composition, Australian Health Survey database (2011–2012) and a newly developed database on food group serves to analyse Australian food and drink purchases for at-home eating.

The report is broken up in four key pillars: eat healthy, move healthy, feel healthy and stay healthy.

It included a number of key findings on Australians’ eating and shopping habits, including that:

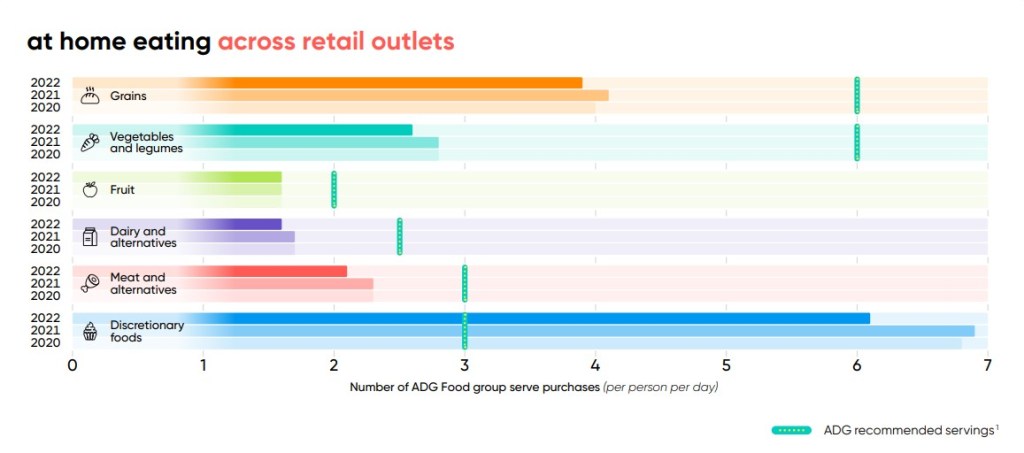

- 6.1 daily serves of discretionary foods in 2022 were sold for Australians to eat at home, down 11.6 percent from 2021

- 2.6 daily serves of vegetables in 2022 were sold for Australians to eat at home, down from 2.8 in 2021 (recommended daily serves is 5-6) and

65.9 percent of purchases for home are core foods (belonging to the key five food groups), up 1.4 percent from 2021.

The data showed that Australians aren’t meeting the recommended daily serves for any of the five food groups, but are well exceeding the daily discretionary food serves, despite a small reduction on last year’s results.

Findings that relate specifically to alternative proteins include:

- Dairy and alternatives: Purchases in this group dropped slightly in 2022. Greek and ‘natural’ yoghurts are the biggest contributors to yoghurt purchases. Fresh milk dropped by around four percent in 2022, while lactose-free milk increased by around 10 percent. “The breakdown between milk and milk alternatives continues to change, with increases in oat, little change in soy and decreases in almond,” the report reads.

- Meat and alternatives: Meat and alternatives purchases dropped slightly, from 2.3 serves per day in 2021 to 2.1 in 2022. Poultry is the number one contributor at 23 percent of total serves, with a steady increase in contribution to serves seen from 2020–2022, while beef has had a gradual decline. Plant-based alternatives, such as tofu and falafel, remain small contributors (around 0.26 percent). However, the report noted a big increase (7.5 percent) in serves of pre-packed ready meals, including many plant-based alternatives.

The report also looked at what motivates Australian consumers to purchase certain grocery items, referencing Heart Foundation data which found that cost is a key driver for one in two people, but taste is the biggest influence.

Health, it seems, is also a growing concern, with the top diet-related food search terms on the Woolworths website being (in order): gluten-free, gluten-free bread, lactose-free milk, vegan, protein, sugar-free, healthy and healthy snacks.

Woolworths is expecting consumers’ interest in plant-based protein to continue growing, citing sustainability, convenience and cost as the key motivating factors.

“There is growing interest in consuming plant proteins as a way to complement rather than replace current eating patterns. Convenience will also play a big role as people seek ways to increase their intake of plant based foods and include more plants, particularly vegetables, in their everyday diet,” the report reads.

“We have seen some evidence of this, with a 7.5 percent increase in the contribution of meat and alternative food group serves from ready-made meals, many of which include plant-based proteins. This suggests that convenience and health may both be contributing to plant-based protein consumption.”

To stay up-to-date on the latest industry headlines, sign up to Future Alternative’s enewsletter.

Posted on: