‘Meat reducer’ has become the most popular diet choice among Australians in 2024, with 21% of the population adopting it, according to a new consumer survey.

The Food Frontier consumer survey – done in cooperation with research company Toluna – interviewed 2,000 people across Australia about their dietary preferences, including meat intake, dietary changes for themselves and their pets, and the reasons behind these changes.

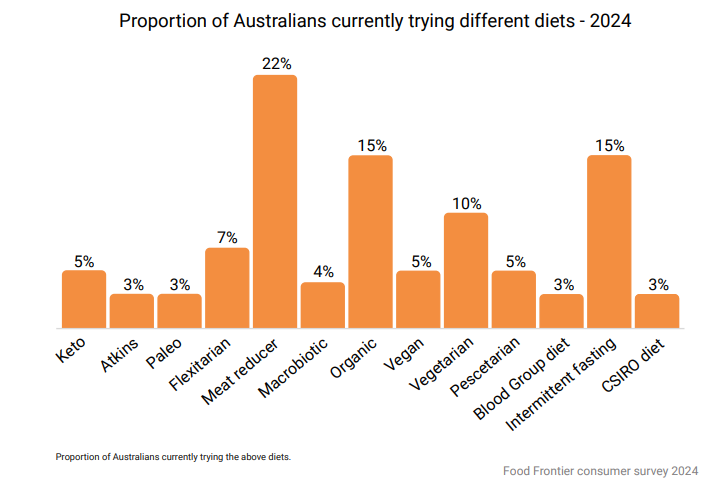

The survey found that the choice of a meat reducer diet was driven by increasing awareness of the health and environmental benefits associated with eating less meat. Respondents could choose from a list of 13 dietary choices, including macrobiotic, vegetarian, and intermittent fasting. Intermittent fasting and organic diets are the second and third most popular diets in 2024.

Australians were also found to rely on various sources for diet information, with friends and family being the most common for those interested in the top three most popular diets: meat reducer, intermittent fasting, and organic. Vegans and vegetarians also primarily hear about these diets from friends and family.

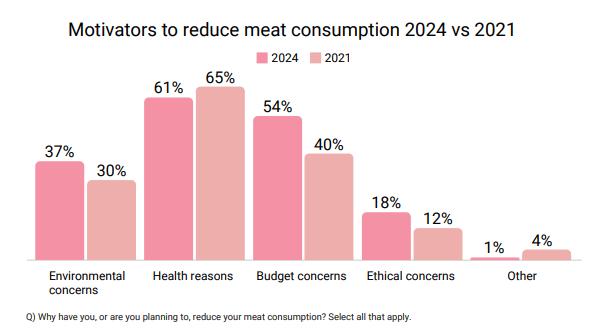

Food Frontier said that the top three reasons respondents gave for reducing their meat consumption, in order of priority, were health benefits (61%), budget constraints (54%), and environmental concerns (37%).

The cost-of-living crisis was also identified as a possible factor affecting meat consumption, with the importance of budget as a motivator for reduced meat intake rising from 40% in 2021 to 54% in 2024.”

What’s more, 75% of Australians go meat-free at least one day a week, which is a similar finding to research undertaken in 2021.

Which alt protein products are Aussies consuming?

The Food Frontier survey also sheds light on the consumption of alternative and free-from food and drinks, discovering that plant-based milks are the most tried and regularly consumed products amongst a list of alternative and free-from food and drinks, with 41% of respondents having tried them. Thirty-four per cent of Australians consume plant-based milks at least once a week.

Close behind, 40% have tried lactose-free milk, and 37% have sampled dairy-free ice cream. Thirty-five per cent have tried plant-based meats, 25% have tried dairy-free confectionery, 25% have tried dairy-free cheese, and 22% have sampled dairy-free dips.

Food Frontier’s recently published 2023 State of the Industry report shows plant-based meat sales in Australia have increased by a total of 47% between 2020 and 2023 and per-capita consumption has increased by 28%.

The survey discovered that of those who would repurchase plant-based meats, just over half do so for health benefits followed by wanting to reduce their consumption of animal meat, while 45% who buy again do so for the flavour of plant-based meats.

Taste and price were found to be the two most significant barriers to repeat purchasing of plant-based meats, with 46% of those surveyed finding a perceived poor taste to be a barrier, while 37% cite high prices and 31% consider plant-based meats to be too processed.

Despite these barriers for some consumers, there are specific reasons why some Australians choose plant-based meats over other types of plant-based proteins like tofu and lentils. Many respondents said they choose both types depending on the meal, with the convenience of plant-based meats and a lack of knowledge in how to prepare other plant proteins also being significant factors for consumers.

Cale Drouin, founder and owner of plant-based meat and cheese company Cale & Daughters, said, “We’re increasingly focused on plant-based dairy, where our cheese sales are experiencing a notable 10% year-on-year growth, highlighting a strong rise in demand. In contrast, plant-based meats have experienced slower uptake.

“We view this as a positive sign of market maturation, with consumers becoming more selective about meat substitutes—focusing on taste, texture, and ingredient transparency. This reflects a deeper awareness and higher standards for vegan alternatives at large. Our customers, who predominantly consume plant-based products, are often not strictly vegan or vegetarian but identify as flexitarians.”

Perceptions of climate change’s relation to animal agriculture

Food Frontier CEO, Dr Simon Eassom, noted that the study also aimed to understand Australians’ perceptions of climate change contributors and how these considerations are influencing their dietary choices.

Data shows that current global food systems—encompassing the production, processing, packaging, distribution, consumption and disposal of food and beverages—contribute between one-quarter and one-third of all global greenhouse gas emissions and trillions of dollars annually in hidden health, social and environmental costs. Moreover, research from climate scientists has calculated that methane emissions from livestock contributed 13% of Australia’s greenhouse gas emissions in 2023.

“It appears that some Australians are making a connection between animal agriculture and climate change; however, from a list of perceived key contributors to climate change, animal agriculture was selected by the least number of study participants,” Dr Eassom said.

“Food waste and deforestation were considered more relevant factors, according to the responses, which does not correspond to climate change data. This would indicate that, despite growing awareness amongst some consumers, more than half of Australians are either unaware or not concerned about the relationship between food production and climate change.”

Even though animal agriculture is seen as a contributor to climate change by 44% of participants, a much smaller percentage of Australians are acting on this knowledge by reducing their intake of animal products such as meat and dairy.

Twenty-two per cent and 16% are reducing their intake of meat and dairy, respectively, compared with 76% who are recycling, and 36% who are using vehicles less and 35% who are buying less consumables to reduce their environmental impact.

An evolving alt pet food market

The consumer survey also found that the pet food market is adapting to consumer interest in diverse options, with more R&D being invested in foods less reliant on animal proteins.

When asked about wet pet food options, 49% of respondents said that they prefer ethically raised/slaughtered animal meat, 44% were interested in minimal animal meat or ingredients, and 38% would consider nutritionally adequate, animal-free options.

Dr Eassom noted that this data was very telling information, referring to a UCLA study showing that pet food releases 64 million tonnes of CO₂-equivalent greenhouse gases in the US and this issue is likely to worsen as the raw, fresh, and gourmet pet food market is expected to grow substantially.

“That pet owners are interested in switching to other foods as long as they are nutritionally sufficient demonstrates a market for sustainable and innovative pet food options, mirroring the growing interest in diverse protein sources in human diets,” Dr Eassom said. “In response to this, we are seeing a number of companies exploring alternative proteins, including cultivated meat, in pet food production.”

To stay up-to-date on the latest industry headlines, sign up to Future Alternative’s enewsletter.

Posted on: