Sales of plant-based meat in Australia increased by 47% between 2020 and 2023, according to a new report from alternative protein think tank Food Frontier.

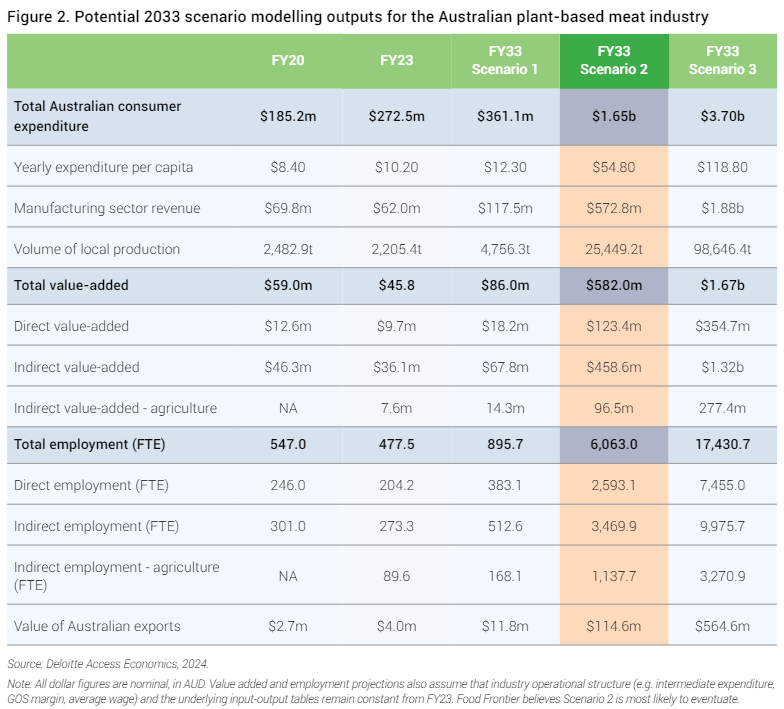

Integrating Deloitte Access Economics insights and industry data by Food Frontier, the 2023 State of the Industry report shows that total plant-based meat sales in Australia in 2023 reached $272.5m, representing a compound average growth rate (CAGR) of 14% since the 2020 financial year.

Food Frontier estimated that Australia has produced roughly 2,205 tonnes of plant-based meat locally.

Among the report’s key findings was a major surge in plant-based meat sales in Australia’s foodservice sector of 59% CAGR since 2020. CEO of Food Frontier, Dr Simon Eassom, noted that the majority of foodservice sales of plant-based meats are in quick service restaurants, indicating, “strong potential for growth if plant-based meat manufacturers expand into new foodservice outlets and across untapped foodservice segments.”

CEO and co-founder of The Aussie Plant Based Co., Alejandro Cancino, also views the foodservice sector as holding the most potential for plant-based meat in Australia.

“As advancements in plant-based meat production continue, efficiency will improve, eventually rivalling the lean production processes of conventional animal meat,” Cancino said. “This will see it eventually scale to compete in the mass market food industry where manufacturers operate on a volume driven tight margin business model.”

Plant-based meats edged closer to price parity

The Food Frontier report found that the Australian plant-based meat industry was on its way to overcoming an issue that had heretofore served as a major roadblock – namely, achieving price parity with conventional meat products.

The think tank notes that in the face of inflationary pressures, plant-based meat products have inched closer to conventional meat prices, with the average price premium for plant-based meats having dropped from 49% in 2020 to 33% in 2023.

The research also showed that Australian plant-based meat products are on average 14.8% ($3.72/kg) cheaper than imported products.

Challenges remain in the retail market

While plant-based meats saw increasing traction in foodservice, growth in the retail market stalled, with retail sales even experiencing a slight contraction (-1% CAGR) from 2020.

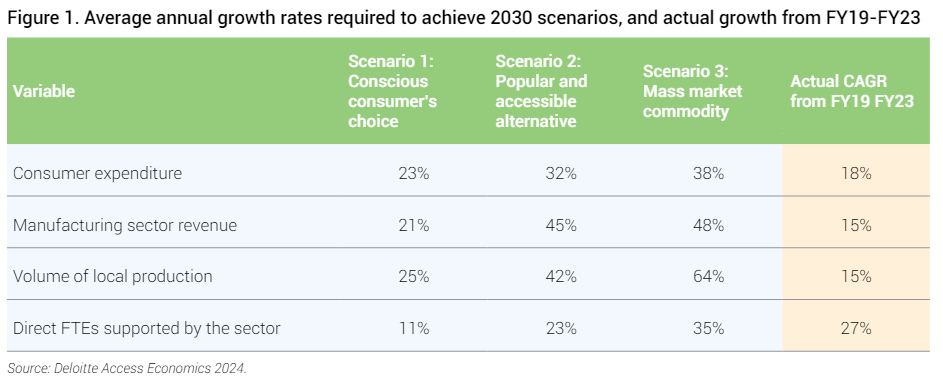

Based on current economic factors and market dynamics, Deloitte Access Economics now forecasts a plant-based meat market size of $1.65b by 2033, down from the 2019 estimate of $2.9b by 2030.

Cancino commented on the retail situation, saying that to survive, plant-based meat companies need to focus on profitability, efficiency, and returning value to the consumer, with taste being “key to the equation”.

Dr Eassom, meanwhile, attributed the retail situation to inflation and increased cost of living, which he noted had impacted all food products perceived as either premium or discretionary.

“Some products were not meeting consumer expectations around taste, and the higher price point compared to conventional counterparts has reduced repeat purchases, leading to a revised forecast value,” said Dr Eassom. “While there is likely to be ongoing expansion in the plant-based meat industry, success within the sector varies among businesses. With the market adjusting during an economic downturn, we can anticipate further consolidation in retail offerings.”

However, Eassom noted that despite the economic challenges, it was clear that the plant-based meat industry was here to stay and that Australia was outperforming other overseas markets amid these challenges.

To stay up-to-date on the latest industry headlines, sign up to Future Alternative’s enewsletter.

Posted on: