The Good Food Institute has released its latest State of the Industry reports, providing a detailed overview of the development of the cultivated, fermentation, plant-based and alternative seafood categories.

The reports cover key technologies, market activity, scientific advancements and government and regulatory developments impacting the growth of alternative proteins.

The most comprehensive global analysis of the alternative protein landscape to date, the reports show that 2021 was the most active year on record for brand launches, private and public investments, retail sales and government recognition.

A summary of the reports’ key findings can be found below.

Cultivated meat and seafood

* 21 new companies entered the cultivated meat and seafood market, a 24 percent YOY increase. There are now 107 companies in the sector. Australia now has three cultivated meat companies

* 2021 saw the first launches of cultivated meat companies in Brazil and Mexico, and cultivated seafood in Africa.

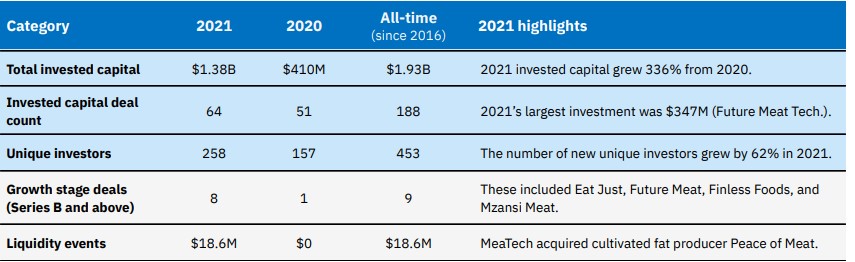

* Investments in cultivated meat companies topped $1.38 billion in 2021, up from $410 million in 2020, with more than 100 new investors entering the space.

* As of the end of 2021, Singapore remains the only nation to approve the sale of a cultivated meat product (Good Meat).

Fermentation

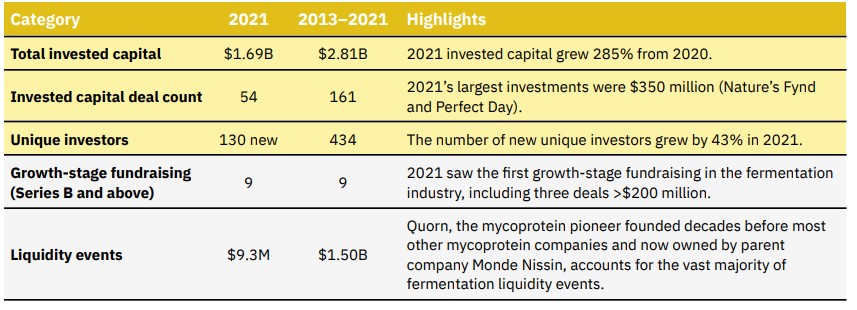

* Fermentation companies focusing on the alternative protein category raised $1.69 billion, almost three times that raised in 2020 and representing 60 percent of all-time sector funding. This also accounts for one-third of the 2021 alternative protein industry funding.

* The number of new unique investors grew by 43 percent in 2021 to 130.

* 15 startups dedicated to the use of fermentation for alternative proteins were founded in 2021, with nine of the 15 focused on precision fermentation and six on biomass fermentation.

* Of the 15 companies formed in 2021, three are in the United States, two are in Estonia, and the rest are in Australia, Austria, France, India, Israel, South Africa, Sweden, Switzerland and Turkey.

* There are now 88 known companies dedicated to fermentation enabled alternative proteins, up 20 percent on 2020.

* At least 11 new manufacturing facilities for fermentation were announced in 2021 across Europe, the US and Asia. Of these, at least eight are focused on biomass fermentation.

Plant-based

* Global retail sales of plant-based meat surpassed $5 billion.

* More than 250 SKUs were added to retail shelves in the US.

* Total US retail plant-based food dollar sales grew three times faster than total food sales in 2021 to $7.4 billion. Plant-based meat sales remained steady at $1.4 billion; plant-based milk sales grew four percent to $2.6 billion; plant-based eggs is the smallest but fastest growing category, and sales grew 42 percent to $29 million.

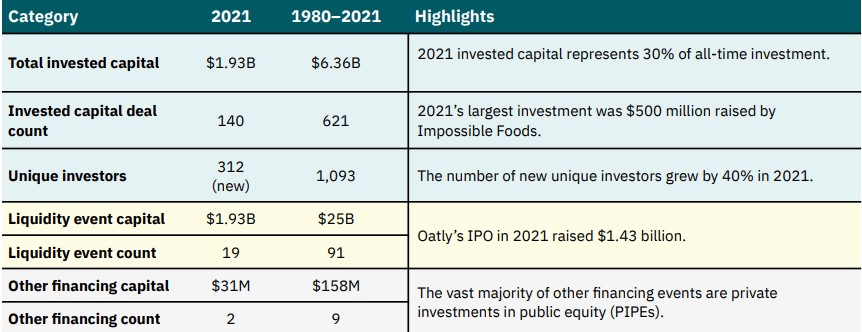

* Plant-based meat, eggs and dairy companies raised $1.9 billion in 2021, bringing total investments in such companies to $6.4 billion.

Alternative seafood

* Alternative seafood companies are leveraging technologies across plant-based, fermentation and cultivated.

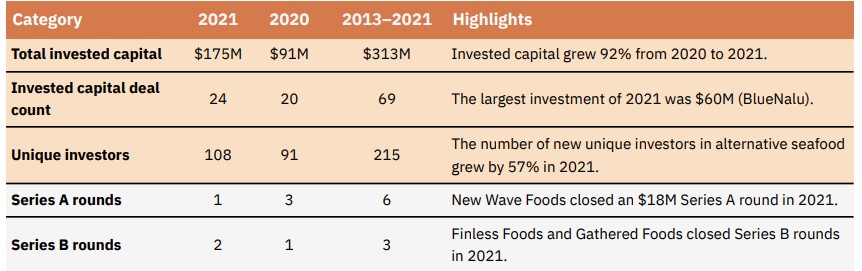

* Alternative seafood companies raised $175 million in 2021, nearly double the amount raised in 2021. The figure brings total investments to $313 million from 2013-2021.

* 2021 welcomed 21 new alternative seafood companies, bringing the total to 120.

* 2021 saw the first launches of alternative seafood in Estonia, South Africa, Latvia, Australia, and Israel.

To stay up-to-date on the latest industry headlines, sign up to Future Alternative’s enewsletter.

Posted on: