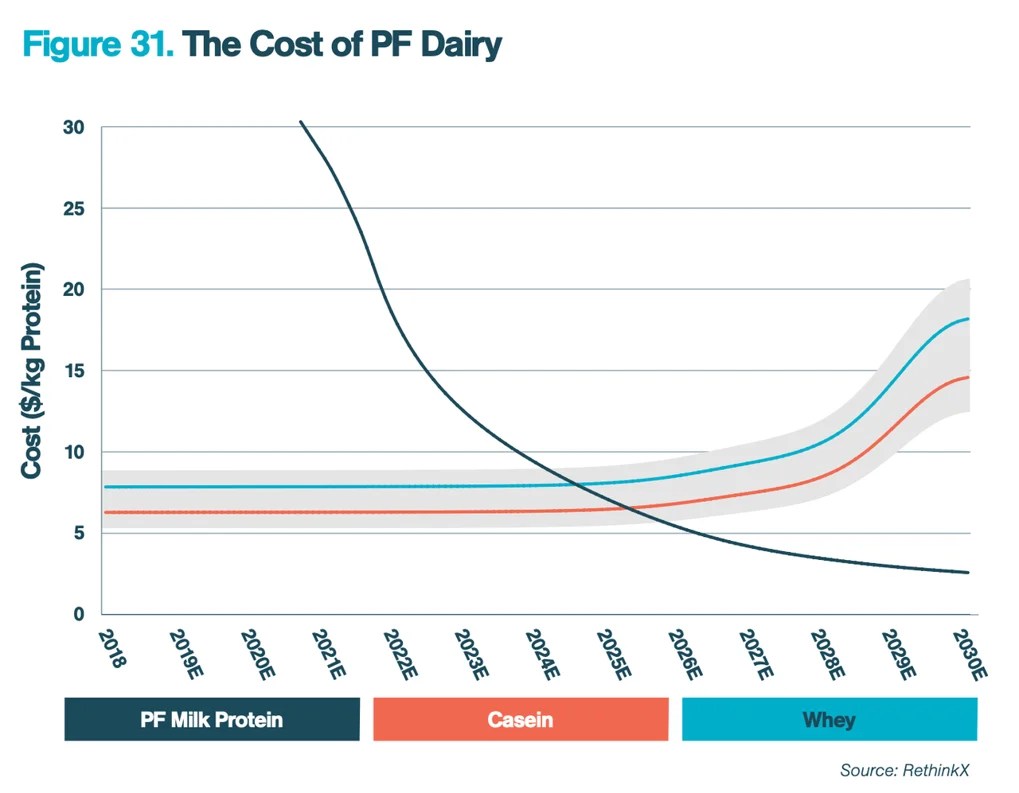

The cost of creating dairy proteins through precision fermentation is quickly approaching price parity with traditional dairy proteins, according to disruptive technologies think tank RethinkX.

RethinkX – which has offices in New Zealand and London – reported in a recent blog article that the cost of precision fermentation-produced dairy proteins has fallen significantly over the past ten years, the think tank’s research pointing to a nearly 70% drop between 2021 and 2023.

The drop in cost in combination with evolving technological capabilities and regulatory frameworks are creating an environment where precision fermentation can be used much more widely in fields such as food.

Precision fermentation refers to the use of programmed microorganisms to produce specific, functional food ingredients, such as dairy proteins like whey or casein. RethinkX emphasises that precision fermentation is not new and that the cost of the technology – which has initially focused on high value products like pharmaceuticals – has in fact been precipitously falling for the past 40 years.

RethinkX said that in its 2019 Rethinking Food and Agriculture report, it projected that precision fermentation produced protein would achieve cost parity with conventional casein and whey around 2024 to 2025. The think tank said that parity is currently within reach, as evidenced by recent regulatory approvals, the growing number of precision fermentation dairy products trialled commercially and available for sale, and the active participation of established dairy players.

From proof of concept to scaling up

Among the factors driving change in the precision fermentation sector that RethinkX highlights is the recent shift from big ideas and proof of concept to a focus on scaling production, triggered by an increasingly constrained funding environment.

RethinkX notes that while the traditional dairy industry is massive by volume with 550 million metric tons of milk produced per year, the protein component of milk is only about 3.3%, the bulk comprising mostly water (87%) along with some fat and sugar.

The think tanks’s previous research claims that novel protein producers targeting that 3.3% could cause major disruption to the traditional dairy industry, thanks to its thin margins, price volatility, and reliance on government subsidies and lobby support.

An evolving regulatory environment

RethinkX highlights how regulatory approval of precision fermentation-produced dairy proteins whey (beta lactoglobulin), lactoferrin, and casein – initially perceived as a major barrier to the technology’s adoption —has significantly accelerated the industry’s progress.

For example, New Zealand precision fermentation company Daisy Lab recently received approval from the country’s Environmental Protection Agency (EPA) to produce dairy-identical proteins using genetically modified organisms in a contained facility.

Meanwhile, companies such as Perfect Day (US) and Remilk (Israel) have achieved regulatory approval for their whey proteins in both their home countries and abroad.

Onboarding ‘Big Dairy’

The RethinkX report also points to another significant emerging trend in the precision fermentation industry, that of “Big Dairy” companies from around the world both investing in precision fermentation technologies as well as developing their own.

Among the most recent cases is Australia’s Nourish Ingredients and NZ dairy co-operative Fonterra partnering to accelerate development of dairy products with fats produced by precision fermentation.

Fonterra – the world’s biggest dairy exporter – also founded Dutch start-up Vivici which, within one year, commercialised whey protein as a B2B ingredient. The company has already achieved regulatory approval for their whey protein in the US.

Meanwhile, Australian precision fermentation start-up Eden Brew was founded by Norco, Australia’s largest and oldest milk co-op, in cooperation with the country’s science agency CSIRO. The company – which is still in the regulatory approval process – will produce casein and whey proteins for processing into dairy products using Norco’s production facilities.

To stay up-to-date on the latest industry headlines, sign up to Future Alternative’s enewsletter.

Posted on: