New research from the Good Food Institute (GFI) APAC examines what would motivate consumers in Singapore, Thailand, Japan and South Korea to embrace alternative seafood products.

According to GFI APAC, the vast majority of the world’s seafood is produced and consumed in Asia, with seven of the world’s top 10 fish-eating countries residing in the region.

Its recent study, executed by Getwizer, surveyed 1,000 residents in each of the four countries, asking them to identify their purchase drivers and inhibitors for alternative seafood products.

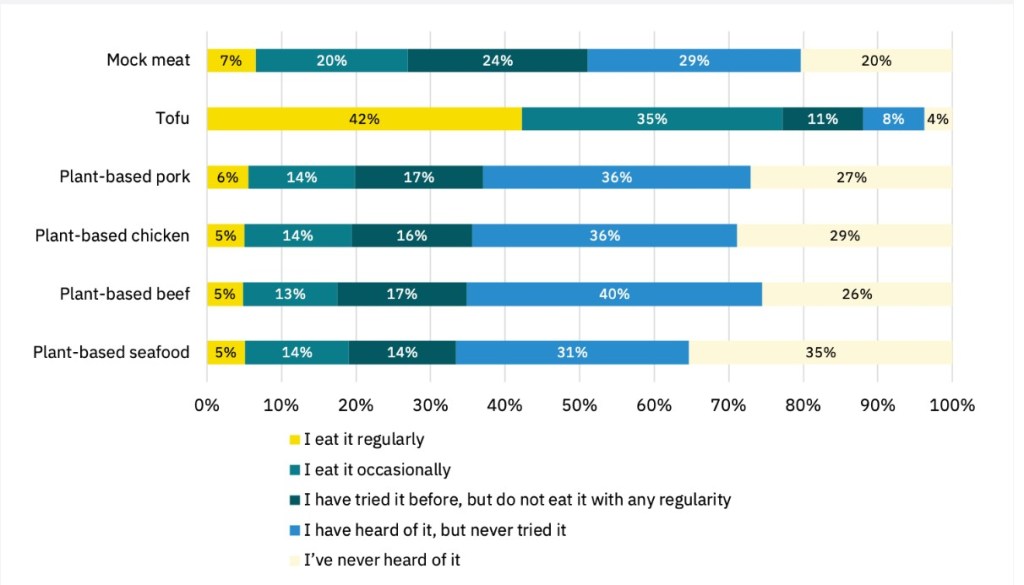

However before being introduced to the concept of alternative seafood, respondents were asked several questions, and it was determined that those from Singapore, Japan, and South Korea were less likely to be familiar with plant-based seafood than other plant-based proteins currently on the market. In Thailand, only plant-based beef was less familiar to respondents than plant-based seafood, indicating that in general, awareness of plant-based seafood remains very low.

How familiar are you with the following?

Drivers

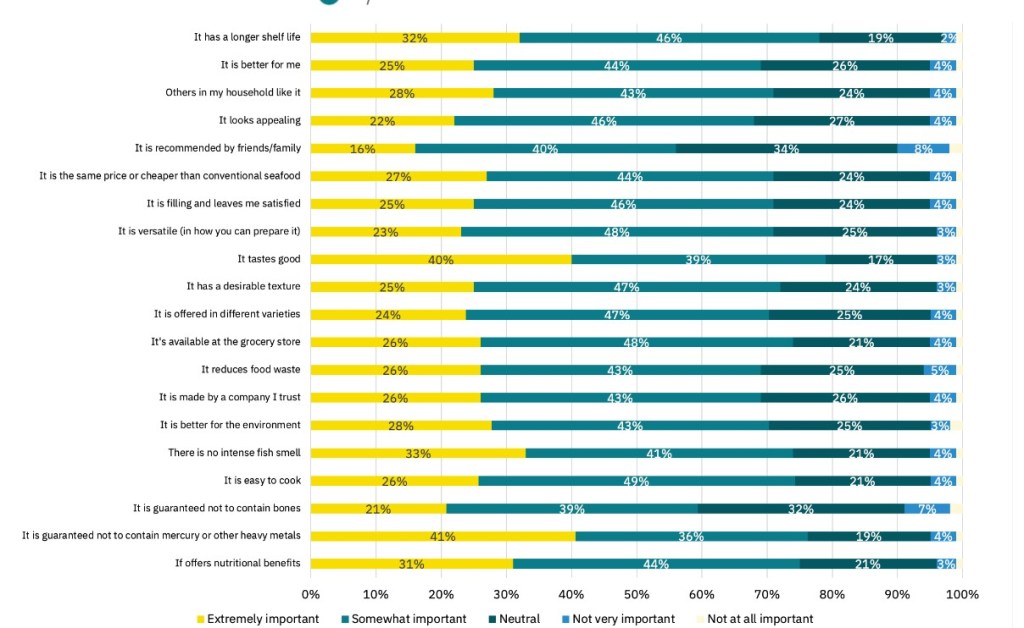

Despite this, the survey found that – across all four markets – the key motivator for consuming alternative seafood products is taste. A guaranteed lack of mercury and other heavy metals, health benefits, and a lack of “fishy” smell were also significant drivers.

Consumers also highlighted the importance of functional benefits such as ease of cooking, shelf life and availability at grocery stores.

How important are each of the following in determining whether or not to buy alternative seafood?

Barriers

When asked what might stop them from consuming alternative seafood over conventional seafood, respondents in Singapore and Thailand listed cost as the main barrier. A preference for the conventional product was identified in Japan, followed by a lack of knowledge about alternative seafood. In South Korea, respondents listed skepticism about the flavour of alternative seafood, and a lack of knowledge.

Respondents were then split into groups and given an introduction into plant-based and cultivated seafood. They were again asked about the barriers that might prevent them from choosing these products.

For both plant-based and cultivated seafood, concern about perceived taste was a leading barrier in all four regions.

In Singapore, other inhibitors for both technologies included concern about freshness and naturalness, and for plant-based, a lack of availability.

For plant-based products, Japanese consumers selected ‘nothing would stop me from choosing it’ as their second response after taste. However, ‘lack of trust’ was a leading barrier to cultivated seafood consumption.

In South Korea, not seeing plant-based seafood in the grocery store was the second leading barrier to plant-based seafood consumption. Preferring to select seafood while it’s alive or freshly slaughtered was also a top barrier to consumption for both plant-based and cultivated seafood. Additionally, lack of trust and concern about freshness and naturalness were leading barriers to cultivated seafood consumption.

Respondents in Thailand ranked lack of availability in grocery stores as the leading barrier to plant-based seafood consumption, followed by concern about taste, freshness, and naturalness. These were also listed as key barriers to cultivated seafood consumption.

For more insights from GFI APAC’s survey, click here.

To stay up-to-date on the latest industry headlines, sign up to Future Alternative’s enewsletter.

Posted on: