At the recent CellAg Summit, Australia’s alt protein industry think tank, Food Frontier, shared never-before-seen data on the perception and awareness of cellular agriculture products in five key Asian markets.

The research was conducted as part of Food Frontier’s recently released report, Alternative Proteins and Asia: Insights for Australian and New Zealand Exporters, which sheds light on the market opportunity for cellular agriculture and plant-based products in China, Singapore, South Korea, Japan and Thailand.

A nationally representative sample of 1000 consumers was surveyed in each market, with 5000 respondents in total. The survey was split into three sections: consumer demographics, behaviours and preferences, and awareness and acceptance of plant-based and cell ag products.

Klara Kalocsay, Food Frontier’s research manager, shared some of the insights that didn’t make it into their upcoming report at the CellAg Summit, with a particular focus on the levels of awareness and attitudes towards cultivated meat and precision and biomass fermentation technologies. Here are some of the key takeaways from Kalocsay’s presentation (you can read more here and access additional findings here).

At a glance…

- Exposure doesn’t equal acceptance. Singapore has the highest levels of consumer awareness due to it being the only market (at the time) where both cultivated meat and precision fermentation dairy products are available for purchase, but in terms of acceptance rates, Singaporeans remain unsure.

- In general, consumers are unsure about cell ag products; they simply don’t know enough about cell ag to make a decision on whether or not they’d buy related products.

- Fermentation is perceived as slightly more trustworthy and tasty than cultivated meat across all markets, but less unique than cultivated meat.

- Purchase drivers for cell ag product include health benefits, as well as environmental and safety concerns relating to traditional protein sources.

- Unfamiliarity is the main purchase barrier in each market, except for Singapore, where high price is the biggest barrier. This tells us that striving to lower prices will be key to winning consumers over once products enter the market.

- Precision and biomass fermentation are perceived as better for animals – more so than cultivated meat.

- Concerns about unnaturalness are significantly lower for precision and biomass fermentation than for cultivated meat.

- Consumers that identify as Unique Product Buyers, Ethical Buyers, Premium Buyers, Eco Conscious Buyers and Early Adopter are 5-10 percent more likely to buy cell ag products.

The Asian opportunity

Australia is located on the doorstep to Asia, a continent that houses around 60 percent of the world’s population. Asia therefore presents the greatest opportunity for alternative protein businesses to make an impact. Already, Asia represents a significant proportion of global meat and dairy consumption, and as we know, this is projected to increase considerably. As with other agri-food categories, alternative protein businesses in Australia and New Zealand have the best chance of succeeding if they can break into international markets, especially in Asia. For cellular agriculture businesses, this could look like the licencing of IP, supplying inputs such as cell lines or growth media, or exporting finished products.

So where are consumers at?

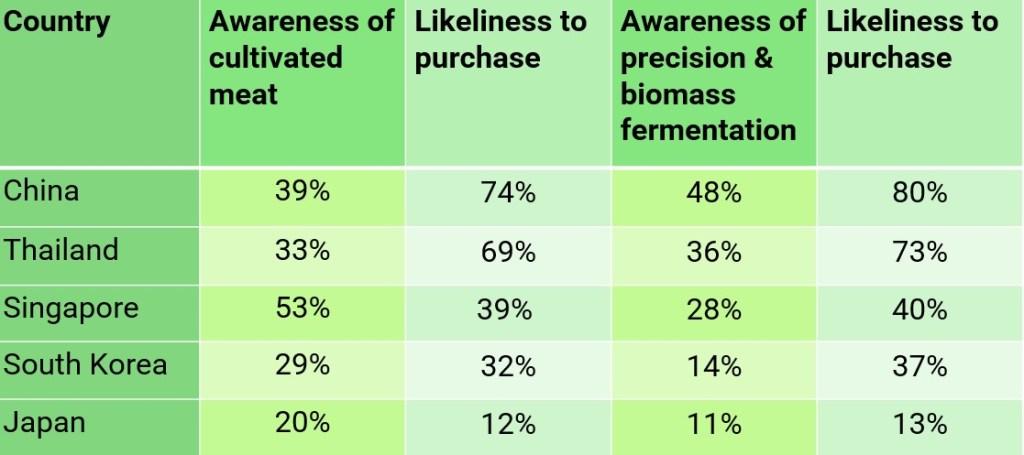

After the consumers were given a definition of cultivated meat, they were asked if they would consider buying it when it becomes available, or in the case of Singapore, more available. The research found that:

- Despite having the highest levels of consumer awareness due to it being the only market (at the time) where both cultivated meat and precision fermentation dairy products are available for purchase, Singapore remains firmly in the middle of acceptance when it comes to both technologies.

- China and Thailand appear as the most accepting markets for both cultivated meat and biomass/precision fermentation

- South Korea and Japan have both the lowest levels of awareness and acceptance.

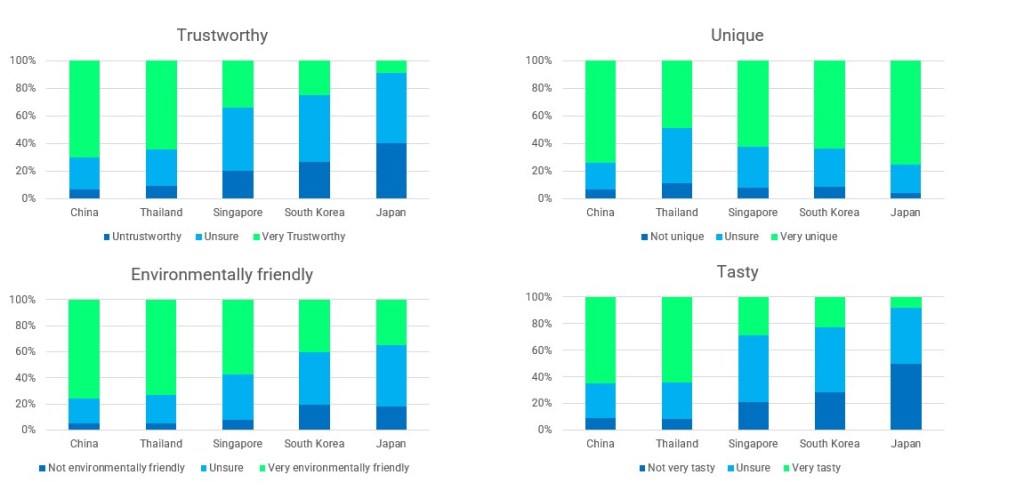

Consumers were asked about their perceptions of cultivated meat on nine different factors: tasty, healthy, exciting, natural, trustworthy, premium, quality, unique and environmentally friendly.

The perception scores for cultivated meat across all five markets mostly remain in the middle of the range (see graphs above). In general, consumers are unsure about cell ag products; they simply don’t know enough about these technologies and require more education about the benefits and attributes of cultivated meat.

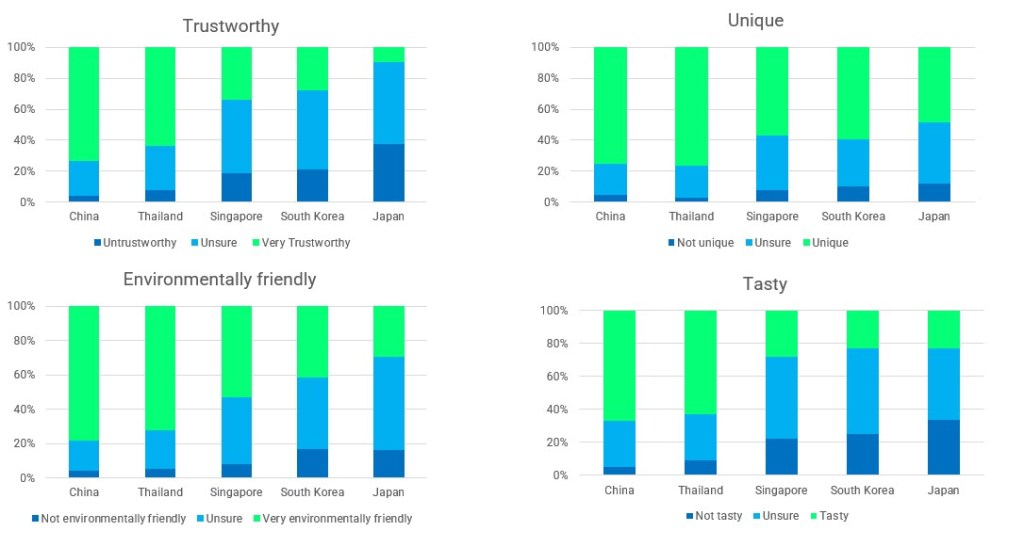

We asked the same questions for precision and biomass fermentation. And again, we can see a similar trend with responses mostly hovering in the unsure range, indicating that consumers need more information about these technologies too.

Interestingly, fermentation is perceived as slightly more trustworthy and tasty than cultivated meat across all markets, but less unique than cultivated meat. Perhaps this is because traditional forms of fermentation are already used in culinary applications across all five markets in products like miso or kimchi.

Purchase drivers and barriers

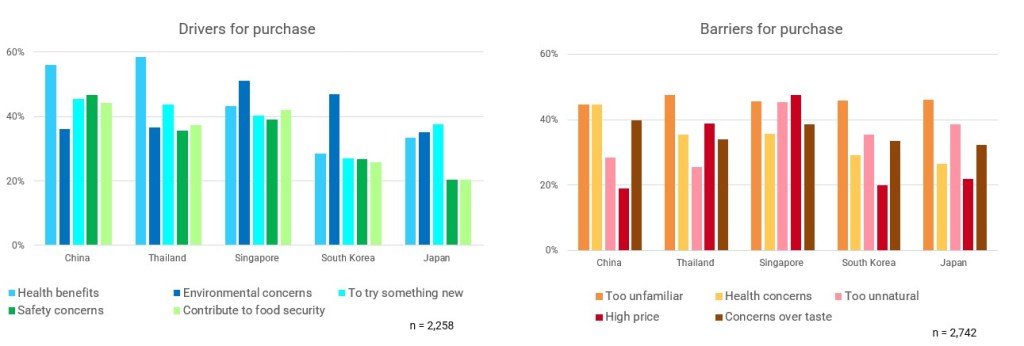

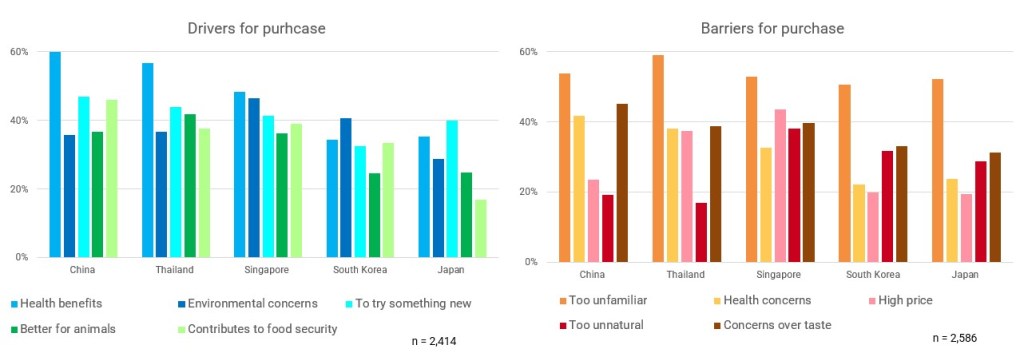

We can see that the health benefits are the biggest driver in China and Thailand, while in Singapore and South Korea, environmental concerns are the biggest driver. In Japan, it’s to try something new. We can see that safety concerns also ranked highly across all markets and this included examples such as to avoid animal borne disease.

For the perceived barriers, unfamiliarity ranks the highest in each market, except for Singapore, where high price is the biggest barrier. This is a really important point as Singapore is the only market with cultivated meat available for consumption, and these consumers are ranking high price as a barrier at almost two times higher than the other markets. This tells us that striving to lower prices will be key to winning consumers over.

We asked the same question about precision and biomass fermentation (see above). We see almost the same trend that we did for cultivated meat, with health benefits ranking highest in China, Thailand and Singapore, environmental concerns in South Korea and Japan again keen to try something new. The big difference here is that we have a new top five driver, better for animals. This might be because precision and biomass fermentation products can be completely animal-free and require no animal inputs.

With the perceived barriers, unfamiliarity is again the highest concern across all markets. However, concerns about unnaturalness are significantly lower for precision and biomass fermentation than they were for cultivated meat. This might go back to our hypothesis about fermentation being perceived slightly better given the use of traditional forms of fermentation in regional cuisine.

Who is most likely to buy cell ag products?

Consumers were asked if they identified with statements regarding their shopping habits, such as ‘I like to try new products’ or ‘I consider how environmentally friendly a product is’ to be categorised into 14 different consumer typologies. The top five consumer typologies were:

- Unique Product Buyer

- Ethical Buyer

- Premium Buyer

- Eco Conscious

- Early Adopter

These consumers are between five to 10 percent more likely to buy cell ag products than the country average in each market, and are likely to be more receptive to consumer messaging when marketing campaigns begin to roll out.

We need to think about marketing NOW

Consumers are making up their minds about cell ag right now, whether the industry is ready for it or not. But Food Frontier’s research shows that the average consumer in these markets doesn’t know enough about cell ag to form an opinion either way, even in Singapore where these products are available. The risk here is that in an information vacuum, consumers are susceptible to misinformation. We need to learn from the failures of other food technology solutions that have been unfairly demonised in the past. The cell ag industry can’t be complacent about the imperative for consumer education, even before we have products on plates.

Building trust is key for consumers in these markets. This can be done by providing simple information that’s accessible to a general audience, to build knowledge and understanding and most importantly, to maximise transparency.

So how can this data be used to inform a consumer outreach campaign in these five markets? Some of the main points that came out in this research is that consumers across the region are interested in and receptive to hearing more about the health, environmental, food security and food safety benefits of cell ag products.

However, we need to remember that these markets are not homogenous and that different markets have different top drivers and considerations. We also saw that consumers need to be reassured about the taste and texture of cell ag products and they are wary of the expected or real high costs of these products. Consumers also need to become more familiar with these technologies and concepts, which will happen over time with exposure but it can be accelerated with target education, harmonised language and messaging can help foster this familiarity and reduce any potential confusion.

To stay up-to-date on the latest industry headlines, sign up to Future Alternative’s enewsletter.

Posted on: