Regenerative food brand Dirty Clean Food (DCF) announced it has begun a crowdfunding campaign via the Birchal platform.

According to a LinkedIn post by CEO Jay Albany, the company has begun taking Expressions of Interest. Albany recently bought the DCF brand for $1.5 million from parent company Wide Open Agriculture, from which he stepped down as CEO.

“It’s been just over two months since taking the company private,” Albany said. “With independence we are free to focus all our energies on growing this brand.”

Images via Dirty Clean Food.

DCF – which sells regeneratively grown produce and meat online – says its products generated $11.5 million in revenue in 2023, gaining significant traction in supermarkets, top restaurants, and over 12,000 households in WA. The company says it is raising funds as a means to scale its impact.

Regenerative agriculture refers to utilising farming practices designed to enrich soil, foster biodiversity, and optimise water and nutrient cycles.

Founded in 2019, DCF is the latest in a series of Australian food tech companies to turn to crowdfunding as a means of raising capital – such as cultivated meat firm Magic Valley and vegan burger brand Soul Burger – amid diminishing private investment.

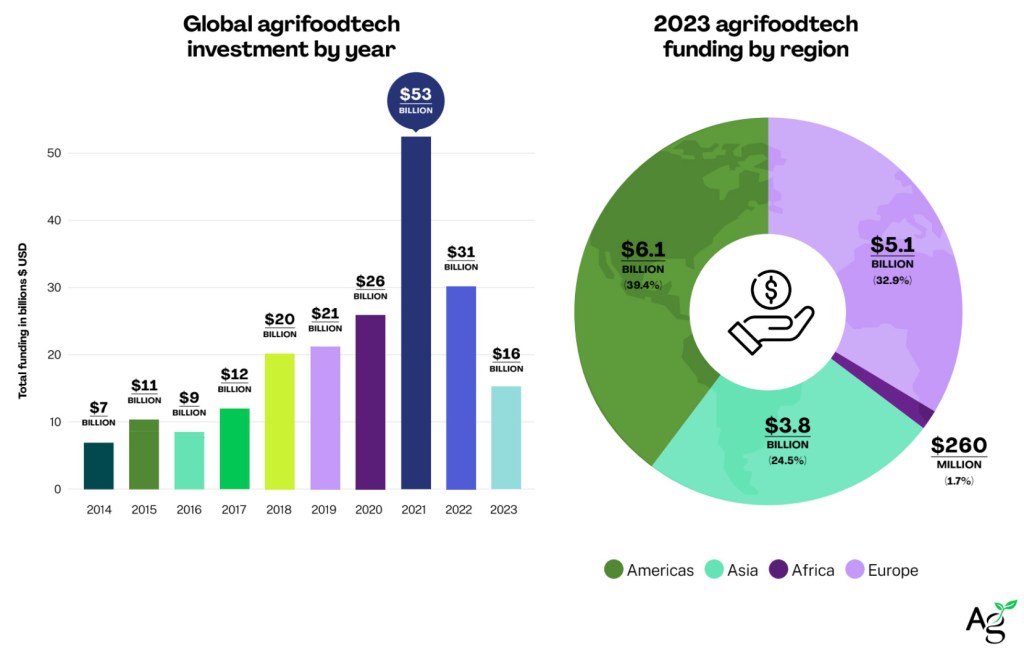

A recent report from AgFunder found that funding in the agrifood sector decreased by 49.2% between 2022 and 2023 to $15.6B, the lowest number the industry has seen in six years. AgFunder added that the decrease was lower than the 35% year-over-year drop experienced across venture capital markets, according to Crunchbase.

However, the report also found that funding to upstream startups – or those operating on the farm or in food production – accounted for 62% of overall dollar investment in 2023, an increase of 51% in 2022. AgFunder emphasised the significance of this increase as upstream tends to include sectors innovating in areas such as climate change, metabolic illness, food insecurity, and agrifood system inequalities.

To stay up-to-date on the latest industry headlines, sign up to Future Alternative’s enewsletter.

Posted on: