Market research company Alternative Proteins Global (APG) has released its first quarterly report, for Q3 2022, on the financial state of the global alternative protein industry.

The free report provides a detailed analysis of investment in the industry and breaks down the data to provide insights into investment in technology across the categories of precision, biomass and traditional fermentation, as well as plant-based, cultivated meat, algae and fungi proteins.

Over thirty different animal products are considered when analysing the potential of alternative proteins. These include products such as egg, honey, fats, pet food and wool, as well as traditional meat and dairy products.

The report also provides a geographical breakdown of alternative protein investment, looking at worldwide trends as well as an analysis into different regions, countries and cities that can provide insights into administrative and regulatory issues in specific areas.

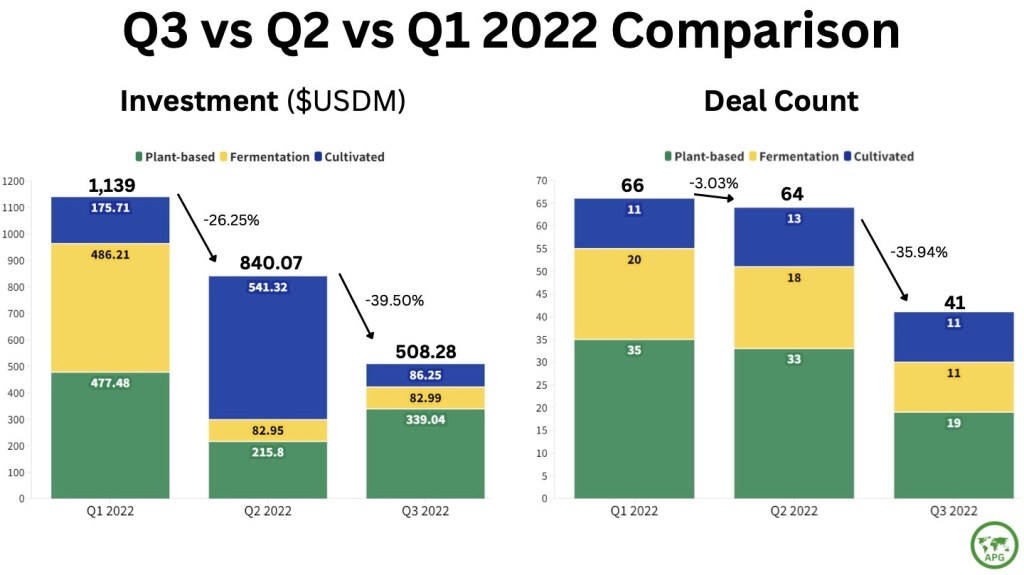

In comparison to the two previous quarters, the industry showed a continued slowdown in investment.

The key figures:

$US508.28 million was invested into alternative protein companies in Q3 2022, which represented a 39.5% decrease from the $US840.07 million raised in Q2 2022. At $US150 million, the largest investment was in Meati Foods, followed by Planted ($US71.44 million) and Oatside ($US65.79 million).

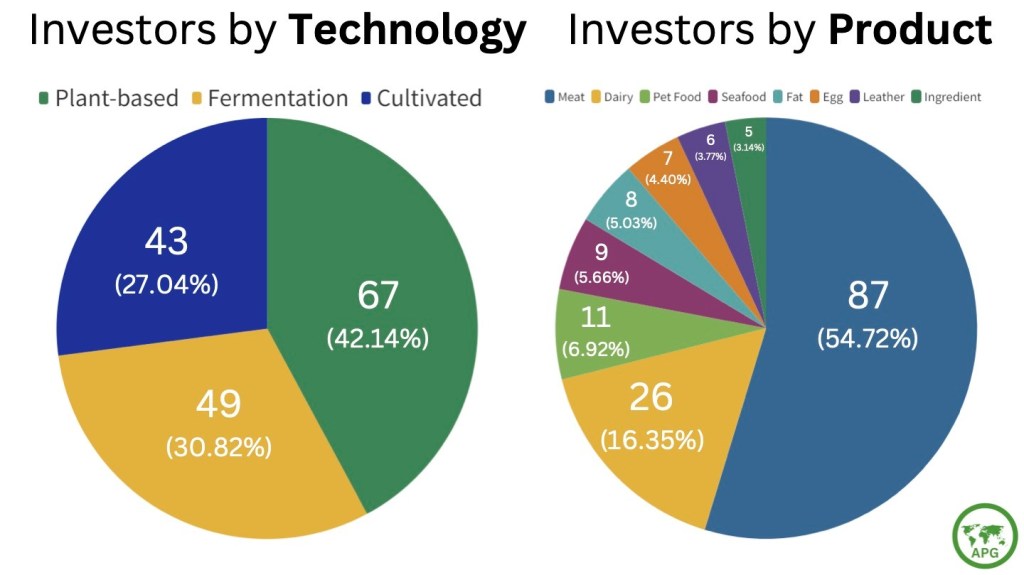

Plant-based alternative protein companies raised $US339.04 million (66.7%) of total investment while cultivated meat companies raised $US86.25 million (16.97%) which was closely followed by fermentation companies at $US82.99 million (16.33%). The number of investors by technology and product was also quantified and visualised.

The breakdown:

Plant-based companies attracted the most deals at 42.14%, with a fairly even split between fermentation and cultivation for the remainder.

With investment of $US259.5 million, the United States accounted for over half of all alternative protein investment funds while Europe accounted for the highest quantity of investment deals at seventeen total deals (41.46% of all investment deals closed).

All G Foods was the only Australian company to feature in the top ten investment deals, courtesy of its $25 million Series A fund raise in August.

Listen to our podcast episode with All G Foods founder Jan Pacas below.

Download APG’s full report here.

To stay up-to-date on the latest industry headlines, sign up to Future Alternative’s enewsletter.

Posted on: