The Good Food Institute (GFI) has released its fermentation state of the industry report, highlighting the investments and trends that impacted the sector in 2023.

One particular form of the technlogy that saw significant milestones — precision fermentation — is the process of combining traditional fermentation with the latest biotechnology to efficiently produce novel food materials such as dairy proteins or fats.

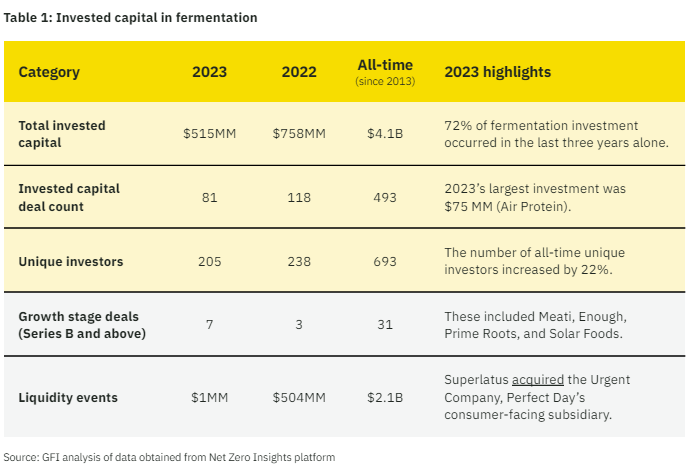

According to GFI, there were a total of 158 fermentation companies focused exclusively or predominantly on alternative proteins by the end of 2023, which saw a total of $515 million invested in such companies, a year-over-year deceleration mirroring similar trends across markets.

However, GFI’s report showed that the number of unique investors in fermentation globally grew by 22%, with funding in Europe totaling $179.4 million, up 22% from the previous year.

Among the notable industry milestones cited in the report were the founding of the Precision Fermentation Alliance and Food Fermentation Europe, which were create to address issues such as regulation as well as labeling and nomenclature for animal-free proteins.

In the United States, the White House released a Building the Bioworkforce of the Future report that explicitly named precision fermentation as a growing sector in the American bioeconomy that would benefit from government investment.

The state of fermentation in Australia

The GFI report shows that 2023 was also an important year for fermentation-based novel food products in Australia.

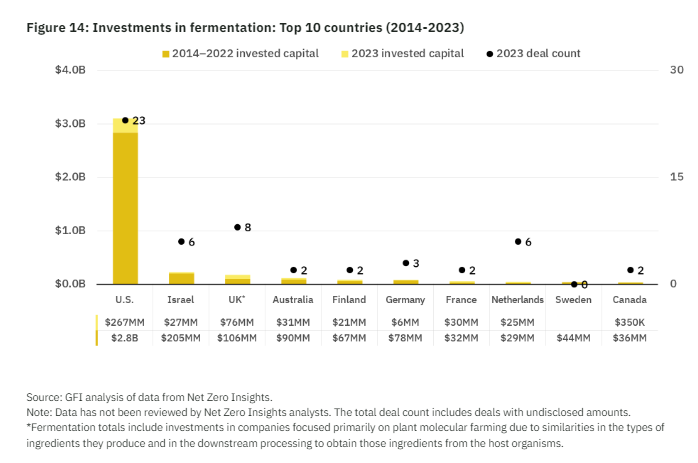

Australia was the fourth largest country for investments in precision fermentation with $31 million invested in 2023, bringing total invested capital from 2014 to 2023 to $90 million.

Among the companies invested in were Eden Brew with a Series A raise of $24 million and Cauldron Ferm, which raised $7 million in seed funding.

In December 2022, the Food Ministers’ Meeting (FMM) accepted that the existing Food Standards Code and labeling requirements in place across ANZ are “well-equipped to regulate precision fermentation products”. These foods will require pre-market approval under the novel foods standard, and the FMM will continue to monitor the need for additional standards based on the number and types of applications for premarket approval received.

On the technology side, Nourish Ingredients identified microbes that can produce the “most potent” fats that allow for taste and sensory parity with animal fats to improve alternative protein products. Meanwhile, Cauldron’s comparable upstream bioprocess claimed to enable more continuous operation and increased volumetric productivity at a smaller scale.

Moreover, Nourish and Cauldron also drove a trend of precision fermentation companies partnering with overseas biotechs to help scale their processes. Both brands teamed with US-based Boston Bioprocesses, while Nourish became one of the first customers for Singapore’s ScaleUp Bio, a Nurasa joint venture contract development manufacturing organization (CDMO).

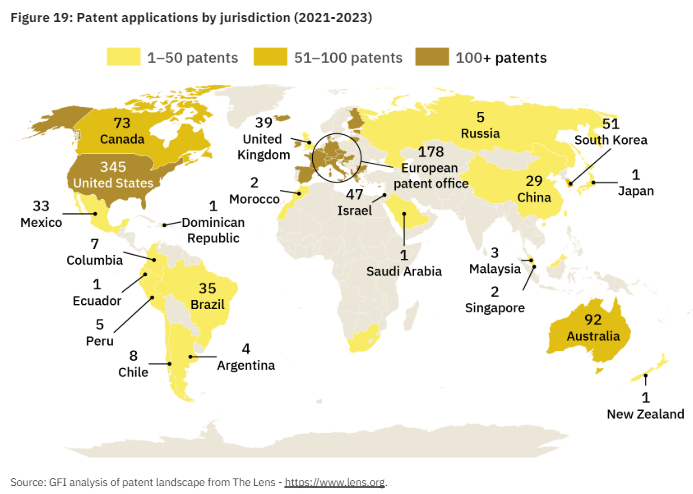

In addition, GFI data shows that Australia holds the third largest number of fermentation-related patents from 2021 to 2023 at 92. Australian companies saw a total of 12 patents in the past 36 months, including 11 by Nourish Ingredients and 1 from All G Foods.

US firm Mycotechnology, a producer of biomass protein and pea/fungal protein end-products, was also awarded an Australian patent for their novel sweet protein from truffle fungi.

To stay up-to-date on the latest industry headlines, sign up to Future Alternative’s enewsletter.

Posted on: