Good Food Institute (GFI) APAC has published its first Alt Proteins State of the Industry Report, providing a broad snapshot of the status of the sector’s investment, research, and start-up ecosystems across the region.

Investment landscape

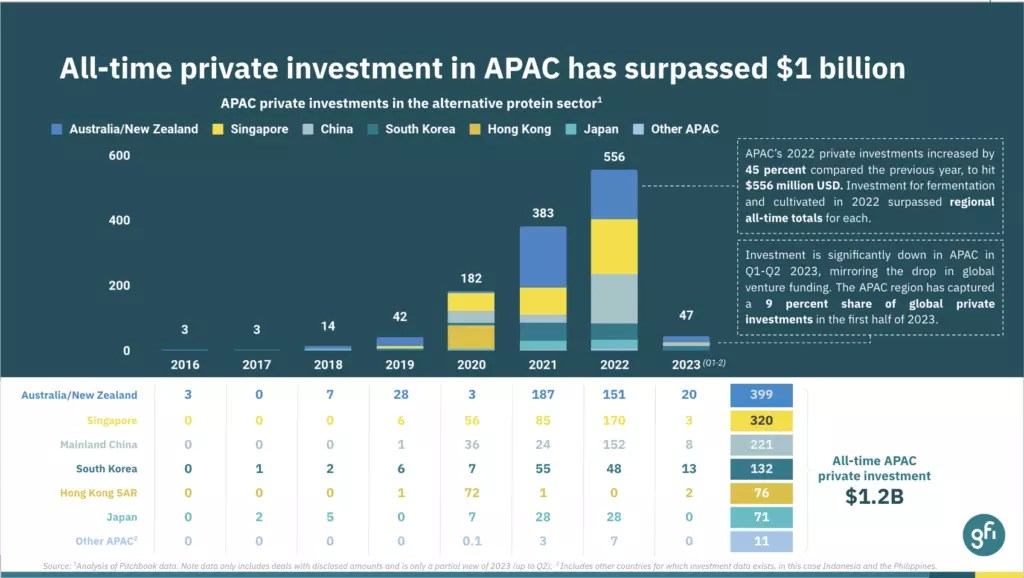

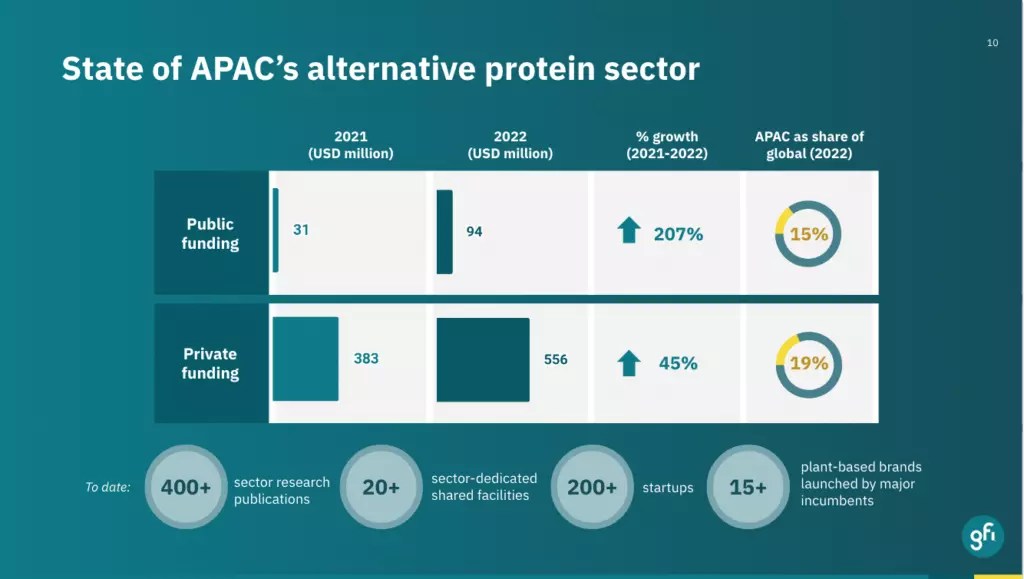

According to the GFI report, public funding for the APAC alt proteins industry shot up by 207% year-over-year between 2021 and 2022, from $31 million to $94 million (USD) – the total accounted for 16% of all public funding in the sector to date. Private funding also saw a significant increase of 45%.

In a country by country breakdown, Australia and New Zealand came out on top with $20M in funding, followed by South Korea ($13M), mainland China ($8M), and Singapore ($3M).

However, GFI noted the recent global downturn in venture funding has had a significant impact on alt proteins, though the research showed that most active investors in APAC still see the long-term potential of the market and plan to continue investing.

Research & development

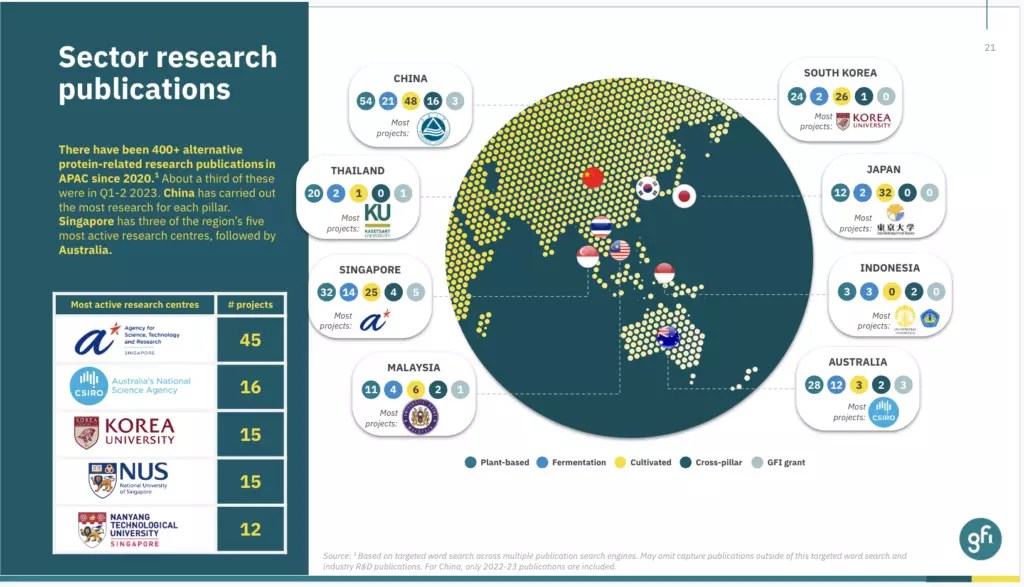

The GFI report showed that APAC-based scientists are forming an increasingly important source of technical knowledge and R&D progress, with over 400 alt protein-related publications coming out of the region in just the past three years.

In terms of ranking for most research activity, China was the top in all pillars, followed by Singapore, with Australia coming in third. Australia’s national science agency CSIRO was listed as the second most active individual research centre in the region.

Start-up ecosystems

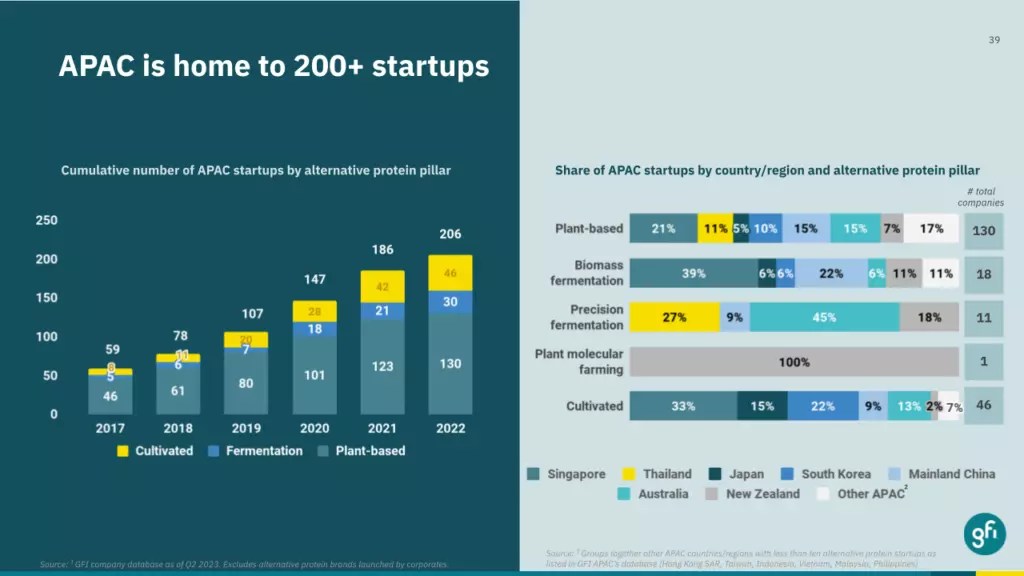

GFI research showed that APAC is home to more than 200 startups, 20 of which launched in 2022. In an inversion from previous years, most of the startups launched in 2022 were focused on B2B solutions versus B2C sales.

Among the countries in the region, Australia and New Zealand were home to the most companies in precision fermentation (such as Cauldron, Eden Brew, and All G Foods), with NZ being the only country with a start-up in plant molecular farming (Miruku).

The report also showed that top APAC-based meat companies, food conglomerates, and biotechnology companies have further propelled alt protein growth by participating in over 20 investments and partnerships with startups.

Corporate-startup partnerships are now underway for end-product development as well as B2B solutions, particularly in the area of cell-culture media development.

Key challenges

GFI noted that despite recent progress in the APAC region, public investment for alt proteins still stands well below the amount needed for the market to reach its full potential.

Despite the 15% of global greenhouse emissions (GHGs) being generated by meat production, global public and private climate financing for the food and agriculture sector only accounts for approximately three percent, with alt proteins only representing 0.5 % of that number.

According to GFI, if funding enabled alt proteins to capture even eight percent of the global meat market by 2030, that shift would create a reduction in GHGs comparable to decarbonising 95% of the aviation sector.

GFI put the number needed to unlock the full benefits of alt proteins at an estimated $10.1 billion (USD) in global public funding per year.

In addition, GFI highlighted the need to address the alt protein industry’s scale-up challenges, an issue numerous cellular agriculture companies in Australia have been addressing through manufacturing partnerships with both local and overseas biotech firms.

The report cited consumer demand as the final piece in the APAC alt protein puzzle, identifying factors such as affordability, nutrition, and taste as some of the biggest barriers in the region.

The full report can be accessed here.

To stay up-to-date on the latest industry headlines, sign up to Future Alternative’s enewsletter.

Posted on: