The Good Food Institute (GFI) has published a new report focusing on the state of alternative protein-related policy across the globe in 2023.

The report covers the status of alt proteins policy through the windows of public investment, regulation, and research and development (R&D), among other areas.

Canada remains the leader for public alt proteins funding

According to the State of Global Policy on Alternative Proteins 2023 report, public investment in the sector increased across the globe along with much-needed support for infrastructure.

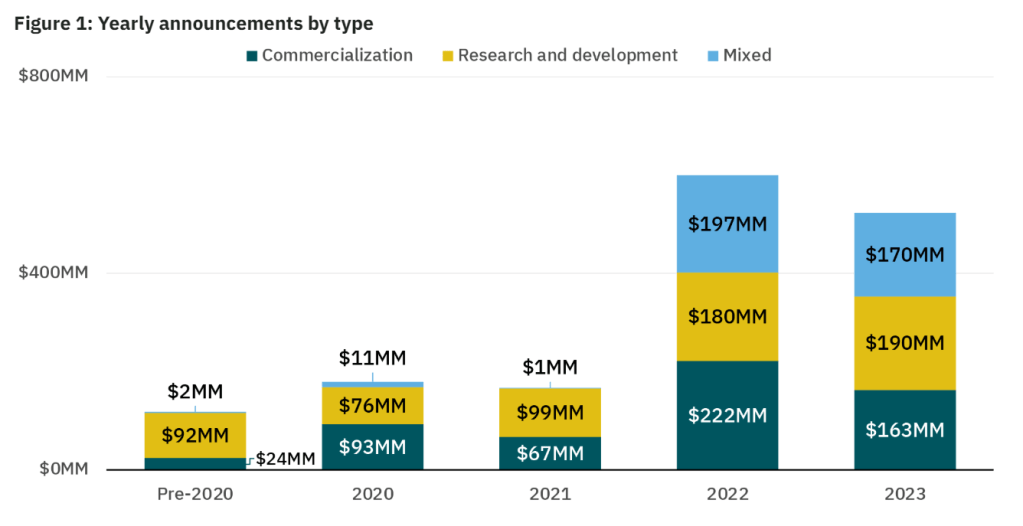

GFI estimates that newly announced global public funding for alt proteins totalled $523 million in 2023, for an all-time investment of $1.67 billion. Out of that total, governments announced $190 million for research and development, $162 million for commercialization, and $170 million for initiatives that mixed elements of both.

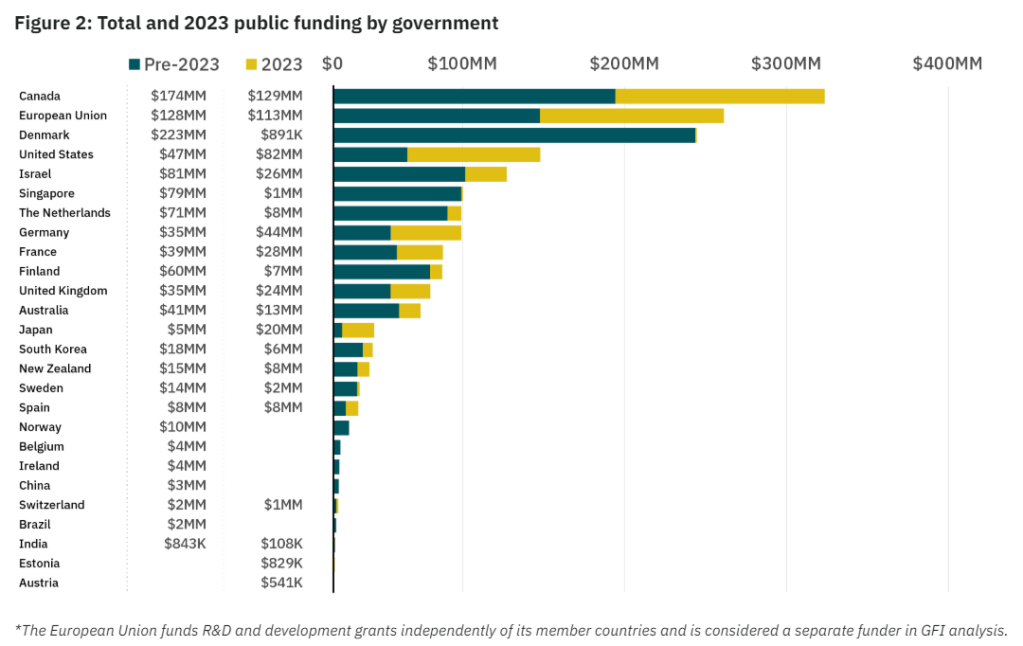

The governments that led the world for public investment were those of Canada, the European Union, and Denmark, with Canada topping the list for all-time investment in the sector.

Australia, meanwhile, ranked 9th for total public investment in 2023 at $13 million, followed by New Zealand, which tied with Spain and the Netherlands at $8 million.

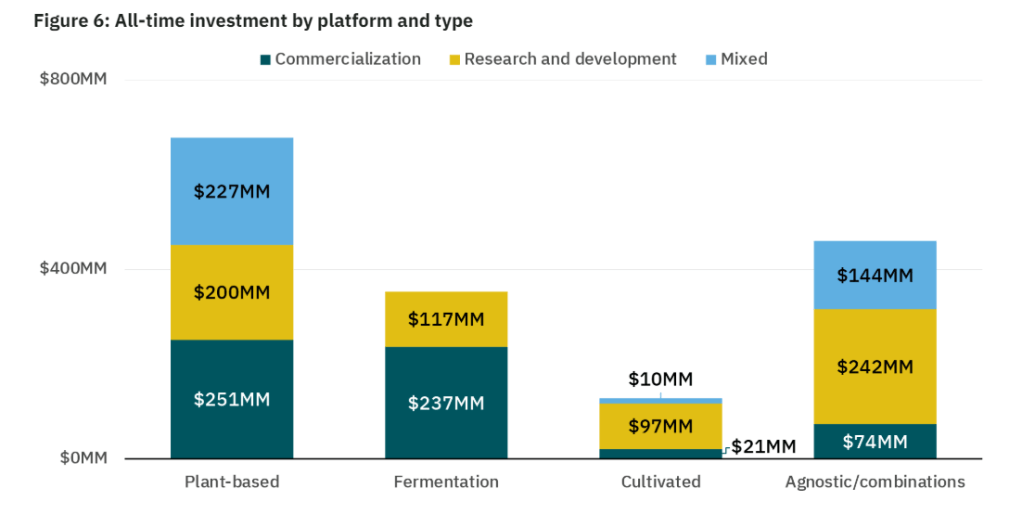

To date, plant-based proteins have received the most public investment globally, followed by agnostic / combination proteins, precision fermentation, then cultivated meat.

Regulation, R&D, & manufacturing

In terms of alt protein regulation, Israel, Singapore, and the United States were identified by GFI as leading the charge.

Meanwhile, GFI singled out Finland, Israel, the Netherlands, Singapore, South Korea, and the US as countries best supporting the advancement of cultivated meat and fermentation technologies through research and infrastructure.

Moreover, the report highlighted Australia, New Zealand, and France as three countries that were supporting the development of plant-based proteins through the boosting of agriculture and manufacturing.

GFI also noted how while Singapore, Australia, and likely China had previously held a commanding regional lead in alt protein investment, several other countries including Japan and South Korea have stepped up in terms of support for the developing field.

Australia stalls on plant protein investment

The GFI report calls attention to the fact that in 2022, Australia’s plant-based protein sector was positioned to be one of the best-supported in the world, second only to Canada. That was due almost entirely to the federal government’s announcement of a AUD$113 million ($82.8 million) grant for the construction of three state-of-the-art pulse protein facilities in collaboration with Australia’s largest meat company.

However the new government’s rescinding of this grant and seven other projects in 2023 set back Australia’s progress. No specific information on the project has been given, and the future of the collaboration and grant was unclear at the time of the report’s publication.

In 2023, however, four of Australia’s six state governments took action to boost their local alternative protein industries. For example, the government of Western Australia allocated AUD $5 million ($3.3 million) to support the construction of a factory that will produce oat milk enriched with lupin protein, both from locally-grown crops.

The other three governments, in addition to Australia’s federal government, made exploratory investments in precision fermentation technology and capacity, noting that Australia is well-positioned to benefit from its use in food applications.

Also noteworthy was the government’s support of precision fermentation – the federal government provided AUD $5.8 million ($3.9 million) in funding to precision-fermented fats producer Nourish Ingredients, while the state of Victoria’s invested AUD $6 million ($3.8 million) in a local facility for animal-free dairy brand Eden Brew.

Meanwhile, Queensland began a feasibility study on building a AUD $300 million ($210 million) Future Foods BioHub to provide large-scale contract development manufacturing capacity in fermentation. And New South Wales allocated AUD $2.2 million ($1.6 million) for the Alternative Protein Application Centre, which will develop large-scale processes and conduct R&D on all alt protein pillars, including fermentation, cultivated meat, and plant-based foods.

NZ lends support to plant-based & cultivated proteins

Regarding public support for alt proteins in New Zealand, GFI highlights the government’s Endeavour Fund awarding funding to two alternative protein projects in 2023.

Almost NZD $12 million ($7 million) was allocated to a project called “Plant-Based Food Ingredients: a Systems Approach to Sustainable Design”, which focuses on developing alt protein products from domestic crops such as green peas, oats, and hemp.

Another NZD $1 million ($585,000) was earmarked for research on cultivated meat technology and scaling, specifically to develop scalable technologies to maintain quality and safety in large volumes.

Both research programmes will be carried out by AgResearch, New Zealand’s Crown Research Institute responsible for agricultural research.

To stay up-to-date on the latest industry headlines, sign up to Future Alternative’s enewsletter.

Posted on: