Allen Zelden is a co-founder of both plant-based modern manufacturing accelerator PlantForm as well as plant-based seafood brand Boldly. In addition to these roles, he serves as a advisor to people and companies in the industry. He is also a frequent speaker at plant-based events throughout Australia.

Future Alternative caught up with Zelden about his views on the state of both the domestic and global plant-based meat markets.

What initially drew you into the plant-based space?

When I exited my digital businesses, I had one simple mission: to create value in people’s lives. I no longer wanted to just build or sell something. I wanted my next venture to reflect my real personality and who I am, what I want to do in life, and the things I’m most passionate about. And I am genuinely passionate about the plant-based foods sector.

Not only has avoiding meat and dairy done wonders for my health and energy, but it’s also the single biggest way to reduce our environmental impact on the planet, sustainably feed our growing population, and end factory farming, which sees over 80 billion animals farmed, fed, and murdered every year for meat consumption.

How did you come to found Plantform, and what is the accelerator’s focus?

After years of working with plant-based food businesses and investors to accelerate the growth of the category, it became abundantly clear to me that the three value drivers for any food business were manufacturing, distribution, and awareness.

Manufacturing typically represents the greatest portion of net proceeds when accessing external capital by plant-based food companies. As opposed to the more impactful value drivers of distribution and awareness.

We launched PlantForm to help the industry move beyond traditional capital forces to accelerate scale and expedite foundational growth for the category.

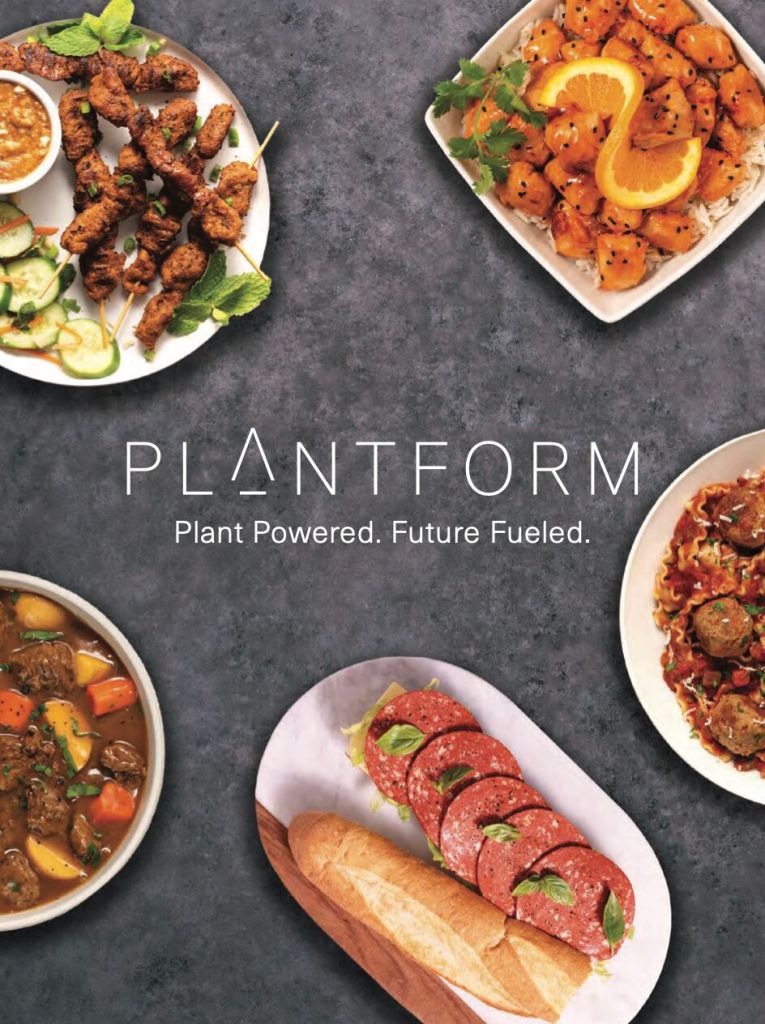

Essentially, PlantForm is the private label arm of a plant-based manufacturing operation with more than 25 years’ experience in worldwide distribution.

Drawing from experience in bringing over 1,000 plant-based SKU’s to market, and having private label customers amongst the top five performers in US plant-based proteins, PlantForm aims to bridge the gap between path to market with the specialist resources required by new and existing companies to scale.

We accomplish this by creating winning partnerships to produce – and access – plant-based foods and leverage a greater global market by virtue of our infrastructure, network, and food-tech product development capabilities.

What do you see as the ideal distribution channel for plant-based meat brands?

As many plant-based food companies are still relatively young brands, the barriers to entry are very high due to either expensive proprietary production costs, or the lack of agility, sophistication, and access to contract manufacturing.

Many of our emerging, independent plant-based food businesses face a challenging landscape in terms of accessing our concentrated supermarket duopoly. According to data, Coles Group and Woolworths Group, whom dominate the Australian grocery retail market by a total 67.5%.

Therefore, it makes sense why the majority of plant-based food businesses today are now investing in gainful entry via foodservice channels as they continue to build brand and demand.

If looking to the USA, the foodservice channel was a key contributor to the success behind many of the most prominent global plant-based food businesses.

For instance, Beyond Meat’s exposure to foodservice businesses was an instrumental growth driver for them, with 50% of their overall net revenue reportedly coming from foodservice sales in 2019 — though this diminished dramatically the following year due to the impact of the pandemic.

Plant-based meat seems to be facing a bit more pushback right now globally, with Beyond Meat seeing tumbling sales and Italy even banning the use of meat-related labels for products. Do you think the industry needs to make a course correct?

Once the industry is able to overcome the hype of agenda-fuelled ‘record-breaking’ headlines, and companies are able to narrow the disparity between capital invested and revenue, the sector will undoubtedly return to its growth trajectory following further consolidation and a greater emphasis on consumer engagement.

From your local supermarket shelves to international markets, plant-based foods are still a booming business. Drawing from my work with PlantForm, I can see the demand is growing exponentially.

For example, data from Good Food Institure shows that private label plant-based meat dollar sales tripled in the previous three years as more retailers added a variety of fresh and frozen plant-based meat products to their store brand lines.

It’s hard not to feel a sense of momentum, and of course we want to see capital funnelled to the most environmental, ethical, and impactful companies.

But given the speed bumps facing the category today, I wish more investors had looked beyond the founding team’s academic and entrepreneurial backgrounds when determining the potential in some of these companies. Do these ‘mission-driven’ entrepreneurs actually embody their mission? Is their passion to positively impact our food systems more ‘fake’ than ‘make’?

I’m forever celebrating the growth of the category as ‘a rising tide lifts all boats’. However, there are a number of exceptional, mission-driven business owners who quietly sacrifice their profits and salaries to invest in more responsible systems, processes, packaging and ingredients — all for the selfless sake to improve their health, environmental, social, and economic credentials.

With shifting consumer values further fuelling the demand for plant-based foods and the category undoubtedly getting more crowded, I firmly believe those brands with strong commercial fundamentals and ingrain purpose in their branding will see more consumer engagement. And those seeking to ‘ride the wave’ will risk becoming obsolete.

Following up on the manufacturing topic, what’s your view on the growing trend of cellag companies partnering with biotech manufacturers to produce their products at a higher scale?

As I don’t work in cellular agriculture or precision fermentation, I can only share my viewpoint from an investment advisory position.

In saying that, I believe that due to weakening investment appetite — thanks to a variety of macro and micro factors — many in these industries are now being forced to look beyond traditional capital forces to accelerate scale and expedite foundational growth for the category. This is similar to the experience in the plant-based sector I described.

With billions of dollars invested to fund the growth and emergence of alternative proteins in recent years — plant-based, precision fermentation and cellular agriculture — the industry as a whole needs to ask itself, what’s holding it back?

To me, it’s our culture of silos. But that’s the nature of capital forces, as the overarching mandate of these funds has typically been business growth, not category growth.

Similar to the industries we aim to disrupt, we need to take a more collective approach where ‘the whole is greater than the sum of its parts’. And whilst I will forever celebrate the progress being made, it’s important to acknowledge that further collaboration, consolidation, and alignment of efforts are required. That’s if we are to truly drive radical system change to reduce our reliance on animal agriculture and catapult the industry forward.

Thankfully, I think that future is very much on the near-horizon.

To stay up-to-date on the latest industry headlines, sign up to Future Alternative’s enewsletter.

Posted on: